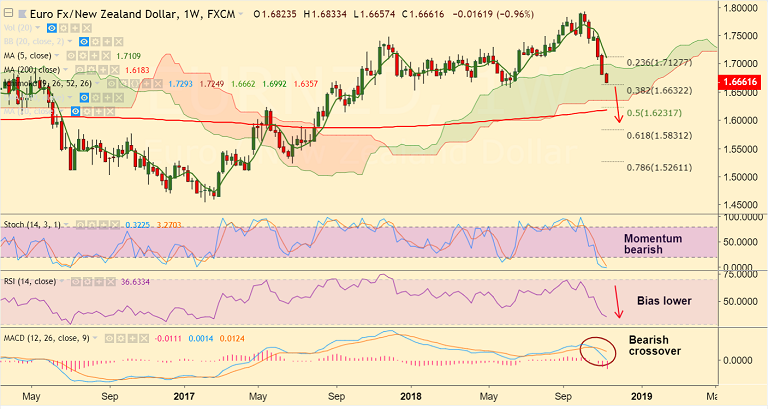

EUR/NZD chart on Trading View used for analysis

FxWirePro Currency Strength Index for EUR/NZD: Bias Bearish

FxWirePro's Hourly EUR Spot Index was at -111.396 (Bearish)

FxWirePro's Hourly NZD Spot Index was at 92.4738 (Bullish)

Technical Analysis: Bias Bearish

- Price has fallen below weekly cloud

- Momentum studies bearish, RSI and Stochs sharply lower

- MACD shows bearish crossover on signal line on weekly charts

- Price action holds support at 110W EMA, breach there to see further weakness

Support levels - 1.6659 (110W EMA), 1.6357 (weekly cloud base), 1.6183 (200W SMA)

Resistance levels - 1.6771 (5-DMA), 1.7154 (200-DMA), 1.73

Recommendation: Stay short on decisive break below 110W EMA, SL: 1.70, TP: 1.6360/ 1.6190

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: EUR/NZD near-term outlook

Tuesday, November 13, 2018 7:05 AM UTC

Editor's Picks

- Market Data

Most Popular

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data