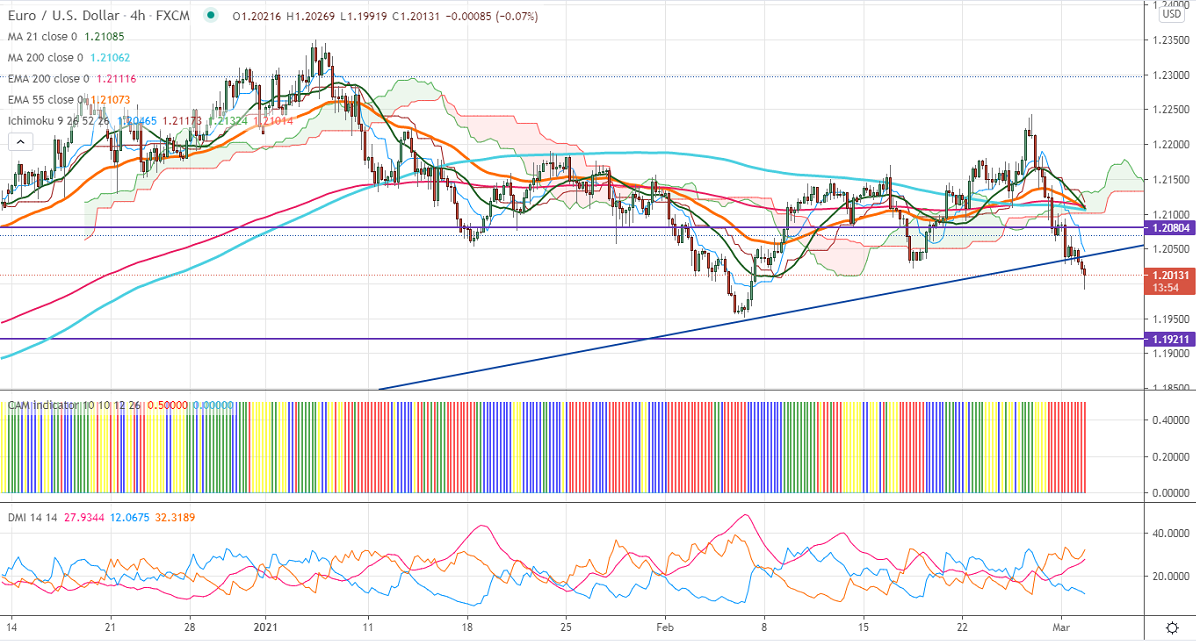

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.20581

Kijun-Sen- 1.21289

EURUSD continues to trade weak for 3rd consecutive days and lost more than 250 pips on broad-based US dollar buying. The risk aversion mood and jump in the US 10- year yield is supporting the US dollar index. DXY gained sharply and rose well above 91 levels. Any violation above 91.60 confirms further bullishness. US ISM manufacturing index came at 60.8% in Feb up by 2.1 percentage points from Jan 58.7%, slightly better than the forecast of 58.7%. EURUSD hits an Intraday low of 1.19919 and is currently trading around 1.200098.

Technical:

The pair is facing strong support at 1.2000. Any break below confirms minor bearishness, a dip till 1.1950 likely. The near-term resistance is around 1.2035. Indicative Breach above will take the pair to next level till 1.2070/1.2120.

Indicator (4 Hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 1.2038-40 with SL around 1.2078 for the TP of 1.1945.