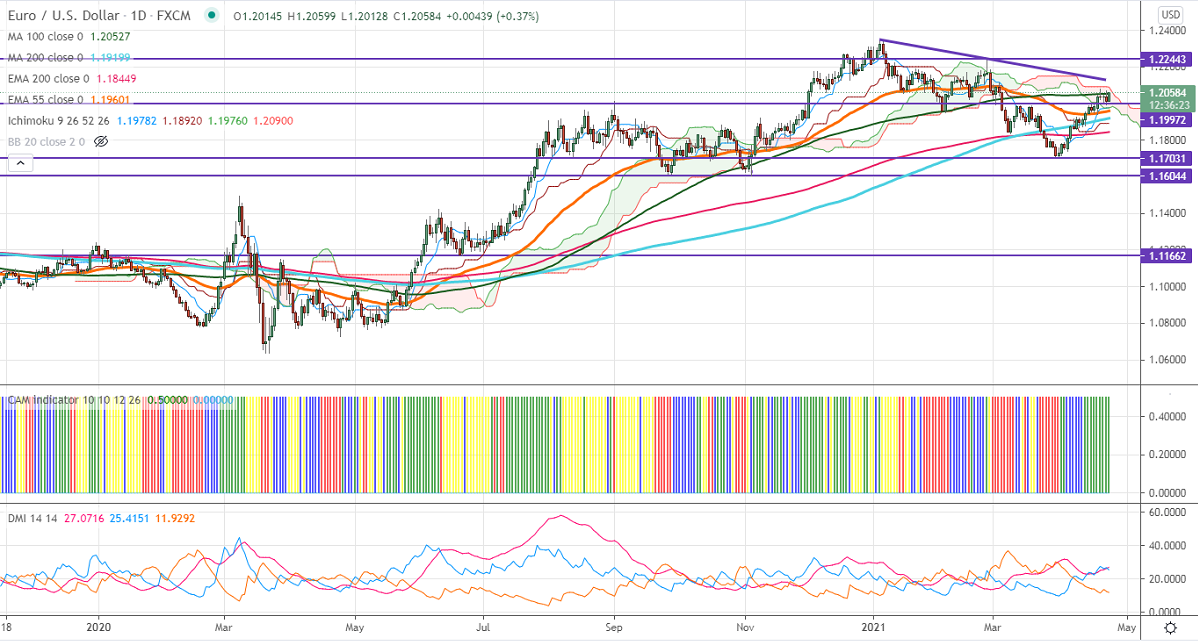

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.19755

Kijun-Sen- 1.18920

EURUSD is trading above 1.2000 levels after three days of consolidation. The European central bank has kept its interest rates unchanged as expected and said that it will continue to buy bonds until the end of Mar 2022. The German flash manufacturing PMI came at 66.4 in Mar compared to a forecast of 65.80. Market eyes Eurozone PMI data for further direction. The number of people who have filed for unemployment benefits in the US declined to 547000 compared to a forecast of 607K. DXY is hovering near 91 levels for the past two days; any decline below 91 confirms intraday bearishness. EURUSD hits an intraday high of 1.20563 and is currently trading around 1.20537.

Technical:

The pair is holding above 100- day MA at 1.2532. This confirms minor bullishness, a jump till 1.20798 (20th Apr high)/1.2120 (Trend line resistance). On the lower side, near-term support is around 1.1990, and any indicative breach below targets 1.1950/1.1900.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.2040 with SL around 1.1990 for the TP of 1.2150.