Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.21242

Kijun-Sen- 1.21242

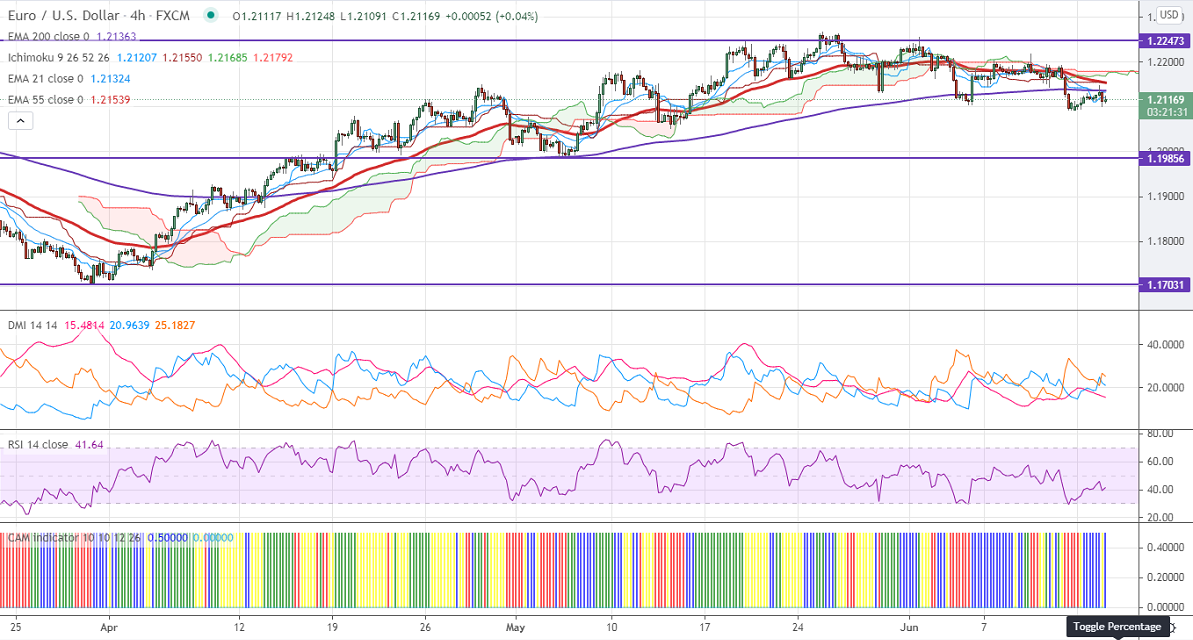

EURUSD has shown a minor pullback in the U.S session after mixed US data. The US retail sales dropped by 1.3% in May much weaker than expected -0.6%. The core retail sales excluding auto, gasoline, building material declined by -0.7% vs an estimate of 0.4%. The US Producer Price Index surged to 0.8% in May slightly higher than consensus. The US-10 year bond yield has recovered some of its loss and jumped more than 2% from its intraday's low of 1.479%. DXY is holding above 90 levels. Any surge past 90.60 confirms further bullishness. EURUSD hits an intraday high of 1.21187 and is currently trading around 1.21188.

Technical:

On the higher side, near-term resistance is around 1.21550, and any convincing breach above will take the pair to next level 1.2200/1.2260/1.2300/1.23485. The pair's near-term support is around 1.2090/1.20400 (100-day MA).

Indicator (1-hour chart)

CAM indicator- Neutral

Directional movement index –Neutral

It is good to sell on rallies around 1.21580-60 with SL around 1.2200 for the TP of 1.2050.