Greece has been drilling depth in bearish sentiments from long ago. Now some more draggers are that Greece finance minister quits from his position and German factory orders MoM dropped to -0.2% from previous flash at 2.2%. Germany in euro trajectory who usually posts good set of numbers now became a dragger in eurozone. As a result, equity segments in eurozone has been weaker. DAX CFDs were down at 40 points, while CAC also dropped almost close to 30 points, Euro stocks are expected to be weaker as well in euro trading sessions.

The dollar was lower versus the other major currencies due to long weekend and as poor US jobless claims. US streets were closed on Friday due to Independence Day holiday.

The dollar remained on the back foot after the latest US employment rates tempered expectations for higher interest rates later this year.

The labor department reported Thursday that the US economy added 223K jobs in June, compared to expectations for jobs growth of 230K.

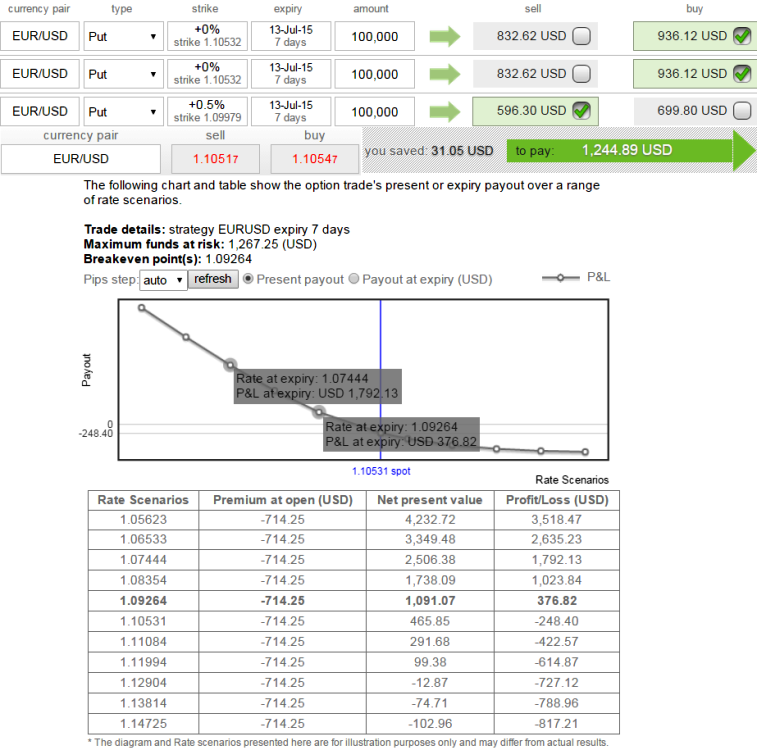

Overall, we expect euro to experience further dips in near future on the present negative fundamental developments. Hedgers are advised to arrest potential downside risks through reverse ratio spreads using At-The-Money put options.

So, buying 2 lots of ATM 0.5 delta puts would mean an equivalent outrights to a short (sell) 50,000 EUR/USD position on each lot in the underlying FX spot and simultaneously short 1 lot of (0.5%) In-The-Money Put option with positive theta of the same maturity.

FxWirePro: Everything goes negative for EUR, Euro equity sinks; EUR/USD PRBS to keep tight hedging

Monday, July 6, 2015 7:29 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings