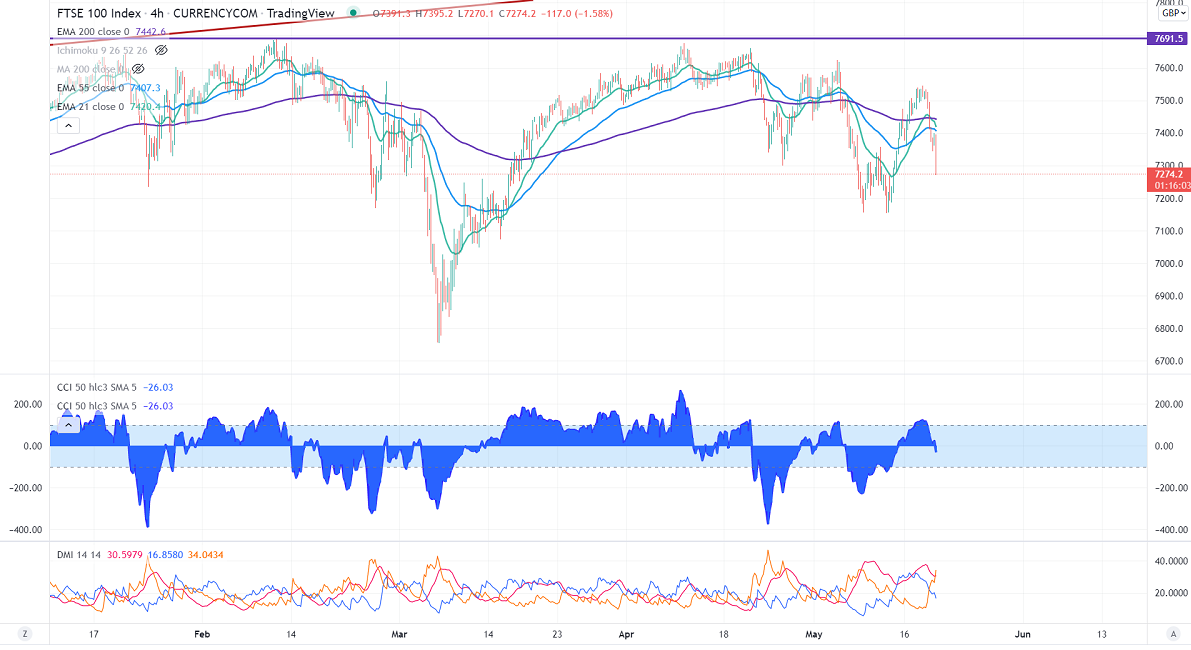

FTSE100 tumbled sharply following in the footsteps of the global equity market. US stock indices especially Dow Jones, dropped more than 1000 points as rising inflation will increase the chance of more aggressive rate hikes by the Fed. The UK yearly CPI came at 9% in Apr, slightly below the forecast of 9.1%, as energy prices soars. FTSE100 hits an intraday low of 7270 and is currently trading around 7270.

Technically, the index trades below 200-day MA, and a dip to 7156 is possible. Any break down 7150 will drag the FTSE100 to 7000/6750.

On the higher side, immediate resistance is around 7332 and breaks above targets 7400/7487/7503.

It is good to sell on rallies around 7338-40 with SL around 7400 for the TP of 7155/7000.