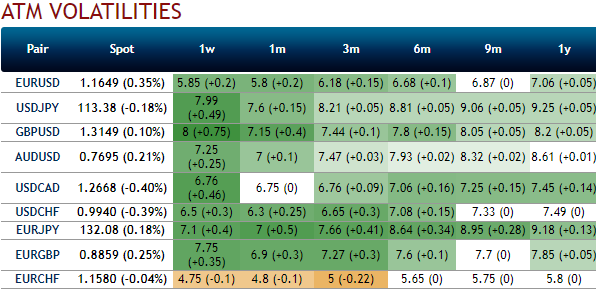

Let’s glance through the above nutshell that’s showing ATM IVs of G10 pairs which are lower side. Despite a mild pick up in IV rise, all the pairs are still displaying below 8% except USDJPY. This lackluster move is to be deemed as the options writers’ advantage.

Especially, USD rather lost its way in the recent past as Trump opted for continuity in the Fed chair, wage growth cooled to a near two year low, and the publication of the House tax bill did little to inform investors about:

1) The political compromises that will be necessary to pay for tax cuts, and

2) The probability and timeline for tax legislation to pass through Congress.

The Fed and tax were only ever bullish tail-risks for the dollar.

Nevertheless, the removal of uncertainty about the Fed chair and a greater sense of realism about the prospective fiscal/monetary policy mix in the US serve to neutralize the dollar’s immediate tactical prospects.

They also deal yet another blow to USD-based FX vols.

The VXY index of G10 FX volatility is approaching 7% -this is four points beneath the post-Trump peak, three points below its 20Y average, yet still two points above the hole that volatility disappeared into during 2014.

For good measure, the market is realizing even less volatility than the derisory amount VXY prices (delivered volatility of only 7.3% for G10 pairs over the past 3 months).

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics