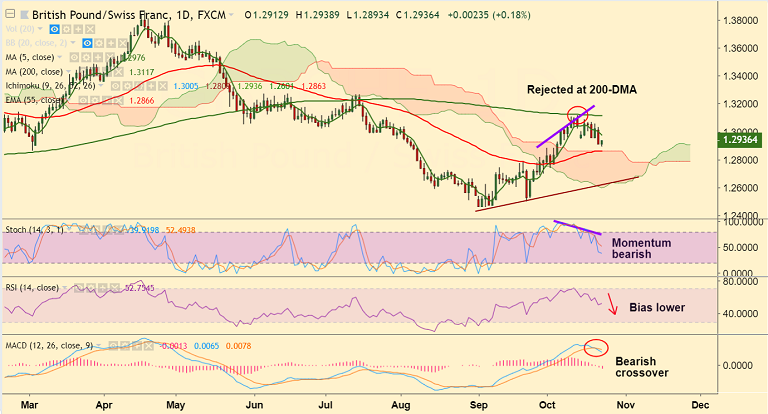

GBP/CHF chart on Trading View used for analysis

FxWirePro Currency Strength Index for GBP/CHF: Bias Bearish

FxWirePro's Hourly GBP Spot Index was at -106.128 (Neutral)

FxWirePro's Hourly CHF Spot Index was at 35.7306 (Neutral)

Technical Analysis: Bias Bearish

- Rejected at 200-DMA

- RSI and Stochs are biased lower

- Bearish divergence seen on Stochs

- MACD shows bearish crossover on signal line

Support levels - 1.2866 (nearly converged cloud top and 55-EMA), 1.2715 (Lower BB), 1.2636 (trendline)

Resistance levels - 1.2976 (5-DMA), 1.3117 (200-DMA)

Recommendation: Stay short on break below 55-EMA, SL: 1.2975, TP: 1.28/ 1.2715/ 1.2640

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: GBP/CHF Trade Idea

Tuesday, October 23, 2018 7:51 AM UTC

Editor's Picks

- Market Data

Most Popular