Refer GBP/CHF chart on Trading View

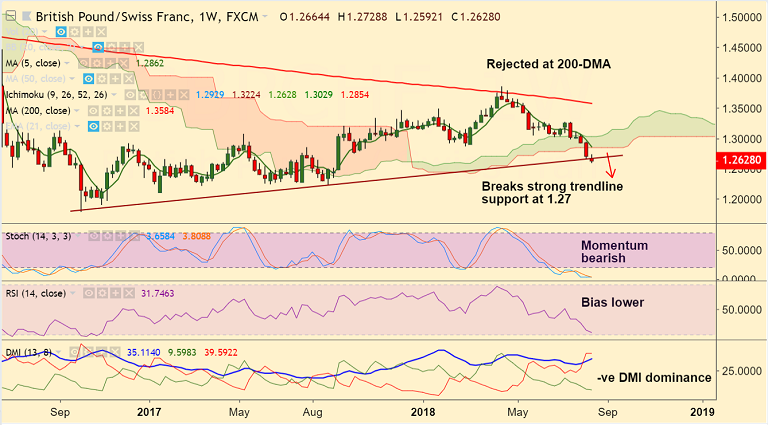

- GBP/CHF has broken strong trendline support at 1.27, bias bearish.

- The pair is extending weakness for the 3rd straight week, hovers around 61.8% Fib at 1.2575.

- Technical indicators on weekly charts are heavily bearish. Price action has dipped below weekly cloud.

- Momentum studies are highly bearish. RSI is well below 50 levels with room for further weakness.

- MACD supports trend lower and DMI also supports downside (-ve DMI dominance).

- Break below 61.8% Fib will see further weakness till 1.2227 (78.6% Fib).

Support levels - 1.2575 (61.8% Fib), 1.2442 (Aug 2016 low), 1.2227 (78.6% Fib)

Resistance levels - 1.2653 (5-DMA), 1.2820 (50% Fib), 1.2850 (21-EMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -123.031 (Bearish), while Hourly CHF Spot Index was at 10.5628 (Neutral) at 0945 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.