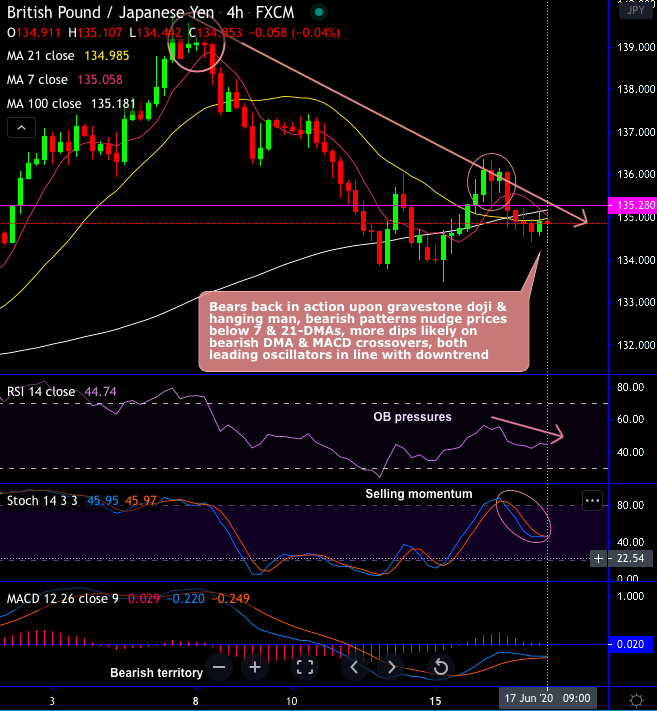

GBPJPY has resumed its bearish business today, even though bulls attempt to make an upside traction yesterday. The pair plunged from the recent peaks of 136.354 to the current 134.442 levels, prior to which it has formed a sharp gravestone doji and hanging man patterns at 139.062 and 135.861 levels respectively.

Consequently, bears are back in action upon these bearish patterns that nudge current prices below 7, 21 & 100-DMAs again.

For now, more dips seem to be likely on overbought pressures, as both the leading oscillators move in line with the prevailing downtrend.

Currently, the interim bulls are exhausted at the stiff resistance zone as per our earlier post, where we had explicitly stated that the resumption of downtrend cannot be totally ruled out.

Major Trend Analysis: The major downtrend still remains intact as the consolidation phase has just retraced 23.6% Fibonacci levels & capped below 21&100-EMAs, the downswings are likely to prolong further as both leading oscillators indicate the selling momentum again.

MACD halts below zero mark which is an equilibrium or bearish territory also substantiates the above bearish stances on a broader perspective.

Overall, we wish to reiterate that as the interim rallies seem to have been exhausted, more slumps are on the cards and the major downtrend unlikely to reverse.

Trade tips: At spot reference: 134.677 levels (while articulating), contemplating above technical rationale, one can execute one touch put options using lower strikes at 134.129 levels. Such exotic option will participate in downside movement and fetch leveraged yields as compared to spot.

In addition, we advocated shorts in futures contracts of mid-month tenors alternatively with a view to arresting potential dips, ahead of BoE and BoJ monetary policies that are scheduled for this week, we would like to uphold the same strategy by rolling over these contracts for July month deliveries since further price dips are foreseen.