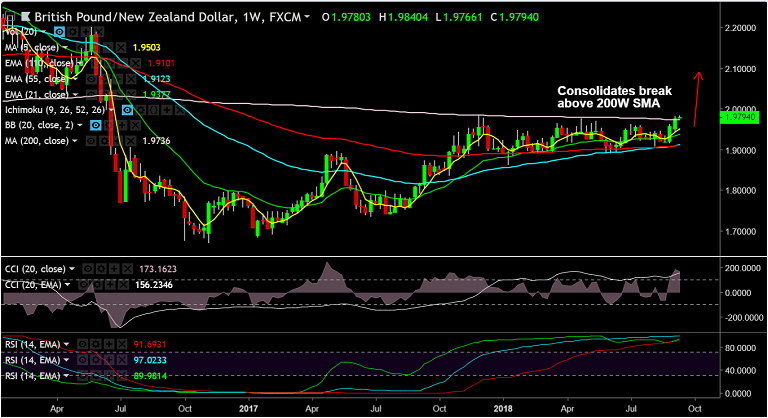

GBP/NZD chart on Trading View used for analysis

FxWirePro Currency Strength Index for GBP/NZD: Bias Bullish

FxWirePro's Hourly GBP Spot Index was at 140.726 (Bullish)

FxWirePro's Hourly NZD Spot Index was at -105.508 (Bearish)

Technical Analysis: Bias Bullish

- Price has broken above 200W SMA

- Momentum studies are bullish, Stochs and RSI are sharply higher

- MACD supports uptrend

- Price action above major moving averages and bias is higher

Fundamental Analysis:

- Data released earlier today showed UK monthly GDP rose above expectations in July while manufacturing output contracted. At the same time, the UK trade deficit contracted less than expected.

- The UK monthly GDP rose 0.3% in July, up from 0.2% expected while UK manufacturing output fell -0.2% m/m, missing the expectations of a 0.2% increase.

- Further, renewed hopes for a passable Brexit deal surface as the EU begins to thaw their frigid positions, supporting the pound.

Support levels - 1.9736 (200W SMA), 1.9668 (5-DMA), 1.9473 (21-EMA)

Resistance levels - 2.0 (38.2% Fib), 2.1011 (50% Fib), 2.20 (May 2016 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-GBP-NZD-struggles-at-196-handle-bias-higher-break-above-to-see-further-upside-1422458) has hit all targets.

Recommendation: Stay long on close above 200W SMA, SL: 1.95, TP: 2.0/ 2.1010/ 2.20

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: GBP/NZD Medium-Term Outlook

Monday, September 10, 2018 10:36 AM UTC

Editor's Picks

- Market Data

Most Popular