The GBPUSD retracements of the previous channel line distance as anticipated earlier on EOD charts, currently trading near channel line support back again at around 1.5556 levels. If a breach of these levels can drag again serious dips resembling previous channel distance.

Bears have kept the prices conservative as %K line attempting crossover below 20 levels on slow stochastic curve. (Currently, %D line at 10.2121 & %K line 6.0453).

RSI (14) is still showing downward price convergence currently trending at 46.8105.

We could foresee serious declines if the above support levels breaches, otherwise all chances of bouncing back upto 1.58 levels.

Currency Option Roundup: GBP/USD

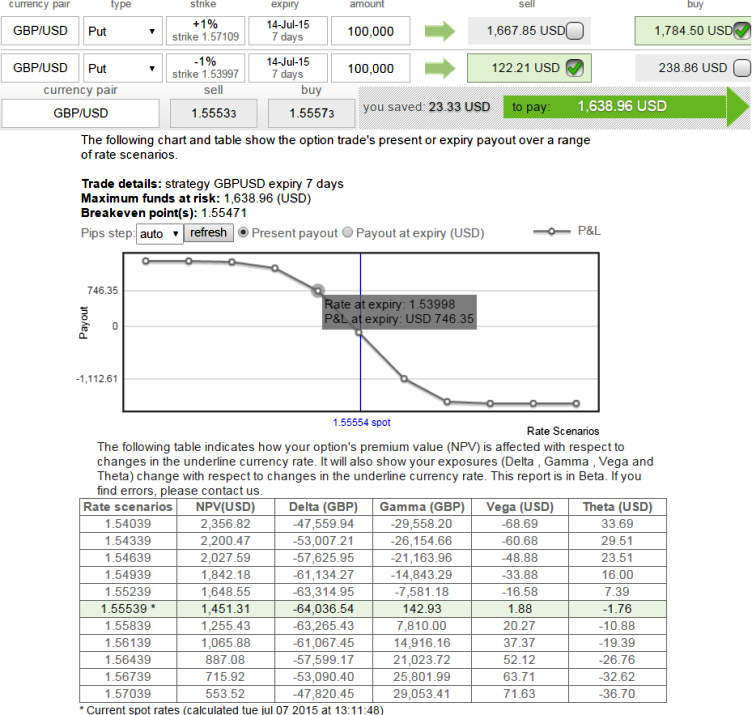

Keeping trend analysis in mind, as a whole intermediate trend being downtrend for this pair, to safeguard those who have huge FX exposures in pounds bear spreads can be deployed at this juncture using ATM puts.

One can also see buying opportunities with speculating mindset in binary puts of this pair may fetch around 25-30 pips with ease and instantly, but the idea has to be buy at dips.

On short to medium term hedging grounds, we advocate bear put spreads with combined -0.64 delta.

Buy 7D (1%) In-The-Money -0.81 delta puts, simultaneously short 7D (-1%) Out-Of-The-Money put with positive theta values for a net debit.

FxWirePro: GBP/USD hedging perspectives; bear spreads keep tight hedge

Tuesday, July 7, 2015 7:49 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary