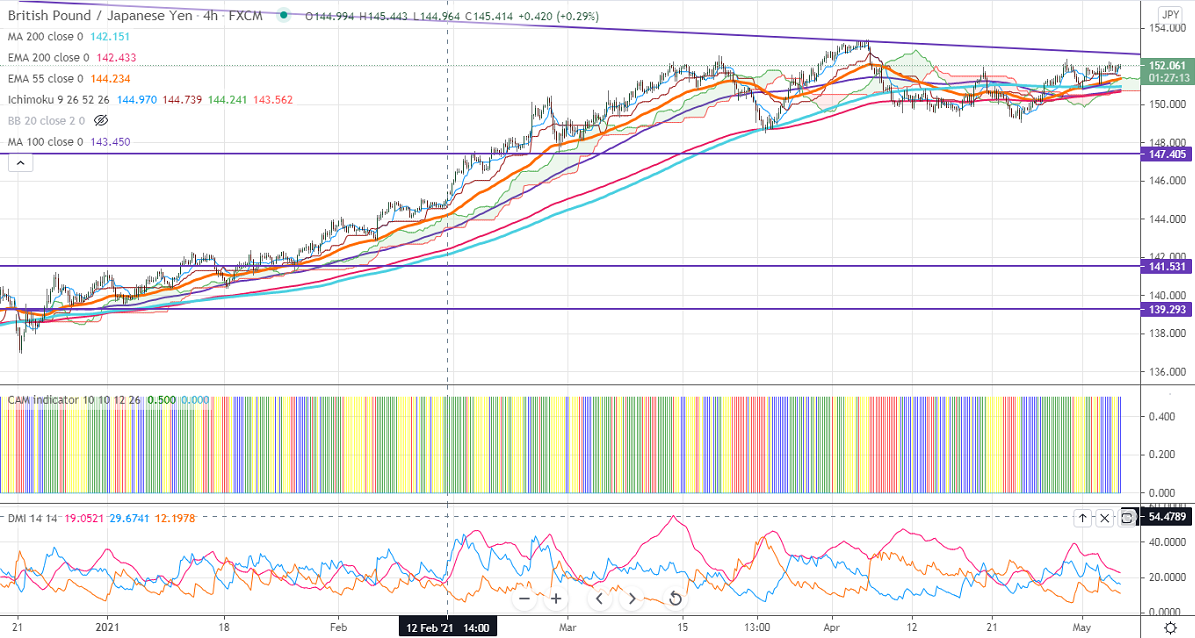

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 151.97

Kijun-Sen- 151.62

GBPJPY is consolidating in a narrow range between 151 and 152.23 for the past two days. The pound sterling is struggling to close above 1.3900 ahead of Scotland elections and BOE super Thursday. The Bank of England is expected to keep rates unchanged and will continue bond-buying. Markets eye growth projection and hints about QE tapering. USDJPY is choppy due to higher equities and declining bond yields. The intraday trend of GBPJPY is bullish as long support 151 holds.

Technical:

The pair's near-term resistance around 152.40, any break above will take the pair to next level till 152.81 (trend line resistance) /153.40. On the lower side, near-term support is around 151.50. Any indicative violation below that level will drag the pair down to 151.10/150.80/150.30. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above 4-hour Kijun-Sen and below Tenken-Sen, cloud.

Indicator (4-Hour chart)

CAM indicator –Slightly bullish

Directional movement index –Neutral

It is good to buy on dips around 151.50 with SL around 151 for a TP of 153/153.40.