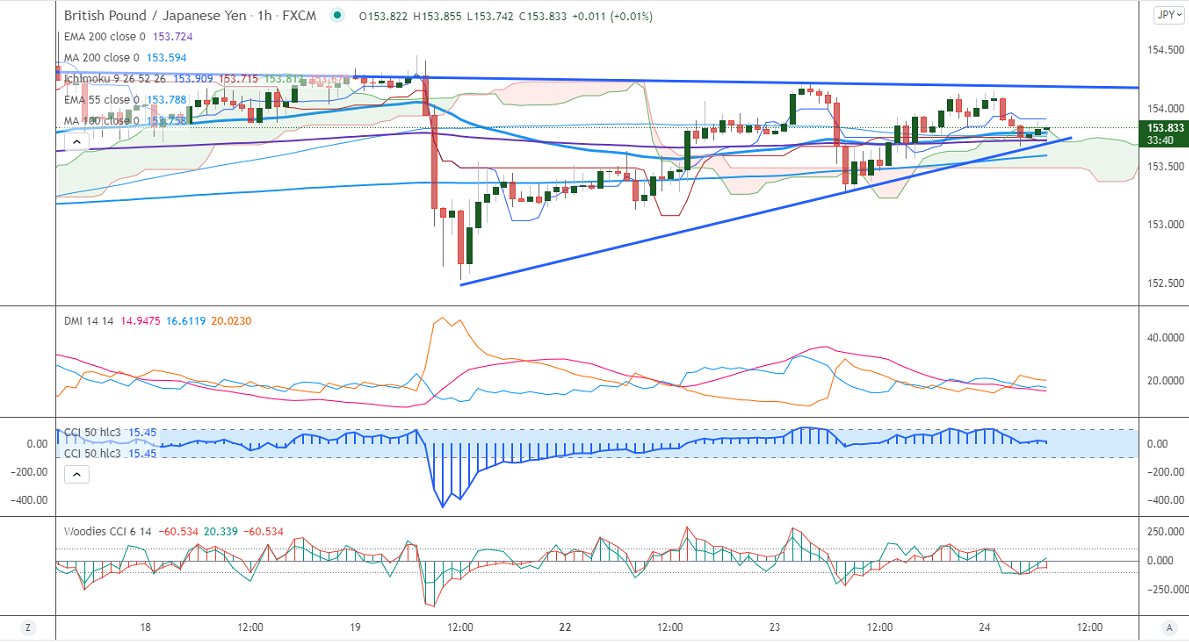

Major Intraday resistance -154.75

Intraday support- 153.40

GBPJPY is trading in a narrow range between 154.15 and 153.66 for the past two days. The pair has recovered slightly after a minor decline below 200-H MA. The slight rebound in pound sterling from 2021 bottom 1.3340 on the upbeat UK flash PMI. It came at 58.2 compared to a forecast of 57.20. Any close below 1.3350 confirms further bearishness. The intraday trend is bearish as long as resistance 154.75 holds. It hits an intraday low of 153.66 and is currently trading around 153.80.

USDJPY- Analysis

The pair hits multi-year high on surging US treasury yields and hopes of a rate hike by the Fed. Any breach above 115.25 confirms a bullish continuation.

CCI Analysis-

The CCI (50) and Woodies CCI are holding above zero level in the 4-hour chart. It confirms a minor bullish trend.

Technical:

The immediate resistance is around 154.25, any break above targets 154.75/155/156. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 153.45. Any indicative violation below targets 152.80/152.50/151.60/150.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to sell on rallies around 153.95-54 with SL around 154.75 for a TP of 151.