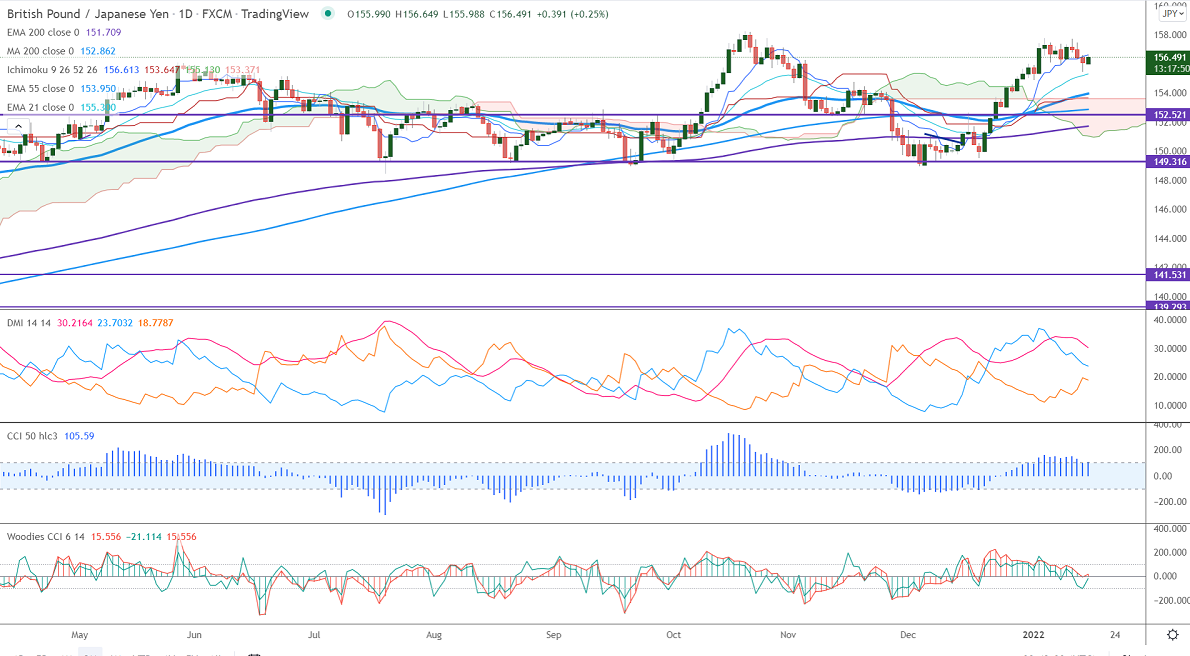

Short-term resistance -157.75

Intraday Support- 155.40

GBPJPY has taken support near 21-day EMA and shown a minor pullback. The pound sterling has been fluctuating in a narrow range between 1.37428 and 1.36530 for the past two days. Markets eye UK political developments for further direction. The latest YouGov/Times opinion poll shows that the Labor party has an 11-point vote lead with 40% of the vote to the conservatives. Any breach above 1.3750 confirms further bullishness. The intraday trend of GBPJPY is bearish as long as resistance 157.75 holds. GBPJPY hits a high of 156.64 at the time of writing and is currently trading around 156.474.

USDJPY- Analysis

The pair showed a recovery of more than 100 pips on surging US bond yields. The intraday bearishness only if it breaks 113.

CCI Analysis-

The CCI (50) holds above zero levels in the 4-hour chart and Woodies CCI below zero line. It confirms the neutral trend.

Technical:

The immediate resistance is around 156.65, any break above targets 157.25/157.75/158/158.50. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is at 155.70. Any indicative violation below targets 155.40/154.70/154.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to sell on rallies around 157.35-40 with SL around 158 for a TP of 155.70.