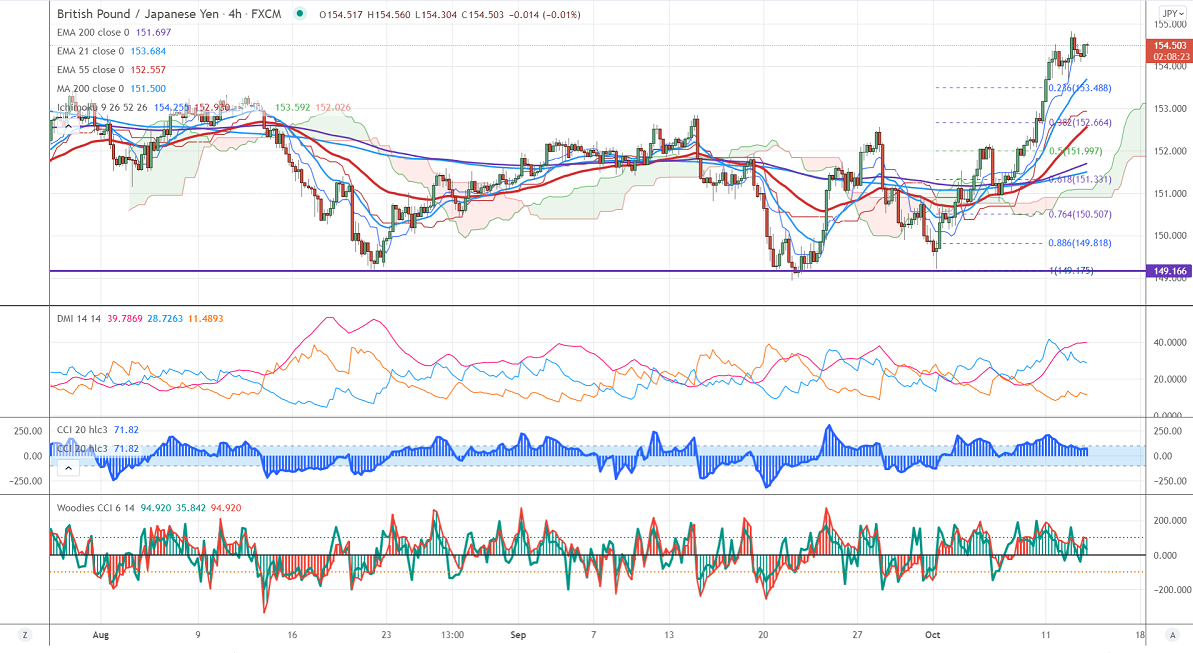

Major Intraday resistance -154.25

Intraday support- 153.40

GBPJPY is trading higher for the second consecutive week and surged more than 350 pips on board based on Japanese yen weakness. The Pound sterling is declined from the high 1.3670 after UK GDP misses estimate. It came at 0.40% compared to a forecast of 0.5%. GBPJPY hits an intraday high of 154.53 and is currently trading around 154.45.

USDJPY- Analysis

The pair hit a multi-year high and shown minor profit booking. The surging US Treasury yields is putting pressure on Yen.

CCI Analysis-

The CCI (50) and Woodies CCI are showing a bullish trend. In Woodies CCI six consecutive bars above zero (bullish trend).

Technical:

The pair's immediate resistance is around 155.15, any surge above targets 155.60/156.10. Significant bullish continuation if it breaks 156.10 On the lower side, near-term support is around 154. Any indicative violation below targets 153.50/152.80.

Indicator (4-Hour chart)

Directional movement index –Bullish

It is good to buy on dips around 154 SL around 153.40 for a TP of 155.60.