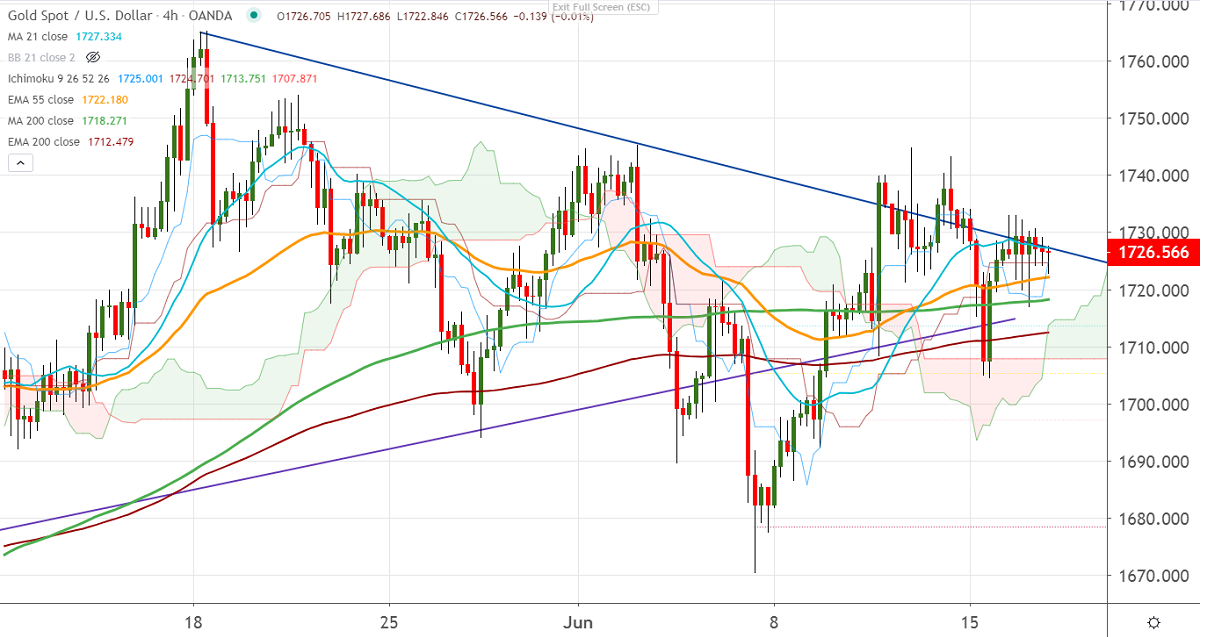

Ichimoku Analysis (4 Hour Chart)

Tenken-Sen- $1718.75

Kijun-Sen- $1724.70

Gold is trading in a narrow range between $1679 and $1745 for the past ten days. The fear of the second wave of coronavirus in China and the U.S is supporting yellow metal at lower levels. Beijing has tightened lockdown and ordered not to leave the city to control the spread of coronavirus. The U.S dollar index gained slightly after better than forecast U.S retail sales. The retail sales surged sharply by a record 17.7% in May compared to forecast of 7.9%, much above the previous month -14.7%.

US Dollar Index – bullish (Negative for Gold)

S&P500- Slightly bullish (positive for gold)

US Bond yield- Weak (mildly positive for gold)

Technical:

The yellow metal is struggling to break above $1745,any violation will take the yellow metal till $1765. Significant trend continuation can be seen if it surges past $1765, a jump till $1800 likely

The immediate support is around $1716, any indicative break beneath targets $1708/$1700/$1679.

It is good to buy on dips around $1705-06 with SL around $1696 for the TP at $1745.