Ichimoku Analysis (Daily Chart)

Tenken-Sen- $1969

Kijun-Sen- $1933

Gold recovered sharply from low of $1862 on a weak US dollar. US Treasury Secretary Steven Mnuchin said that the White House and Democrats failed to reach an agreement. The US 10-year yield retreats from 5-week high as US stimulus deal hope fade. US Consumer prices rose 0.6% month-on-month compared to a forecast of 0.3%. The US 10-yield recovered more than 30% in the past four days and real yield is at -0.98% from -1.08%.

US Dollar Index – Bearish (negative for yellow metal)

S&P500- Positive (negative for gold)

US Bond yield- negative (positive for gold)

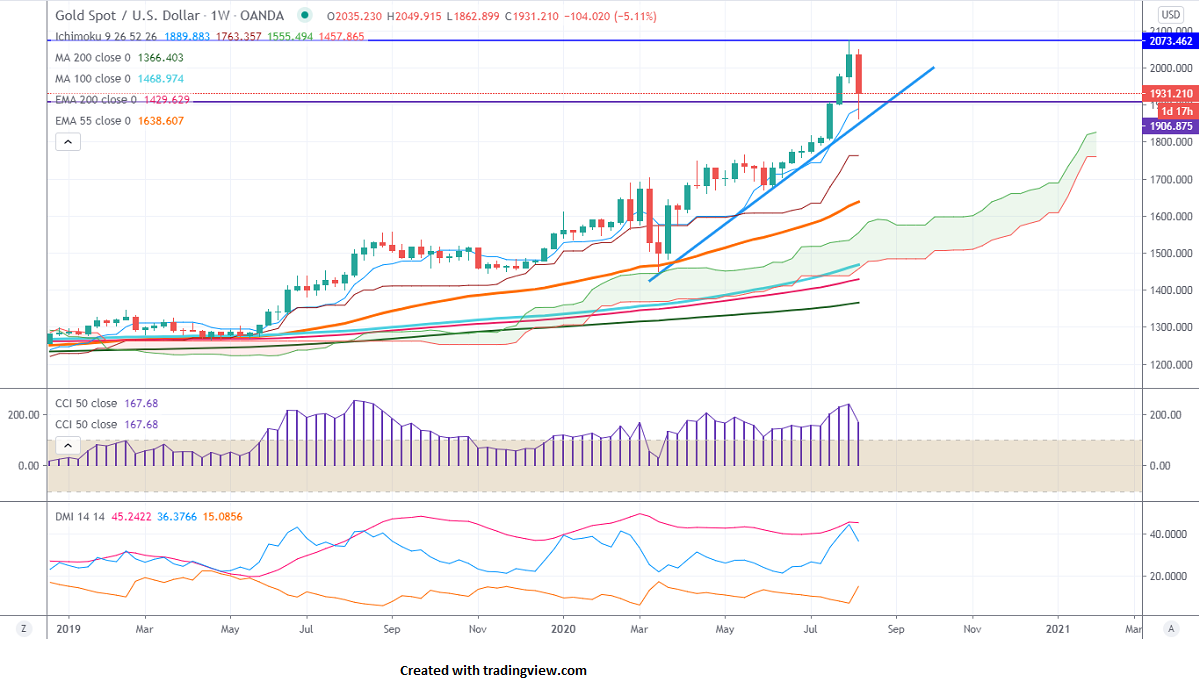

Technical:

The yellow metal is trading slightly higher and hits a high of $1950. It is currently trading around $1930.

The immediate support is around $1860, any indicative break below targets $1846/$1825/$1800. The near term resistance is at $1950, the violation above will take the commodity to next level $1968/$2000.

It is good to sell on rallies around $1952-53 with SL $1970 for the TP of $1800.