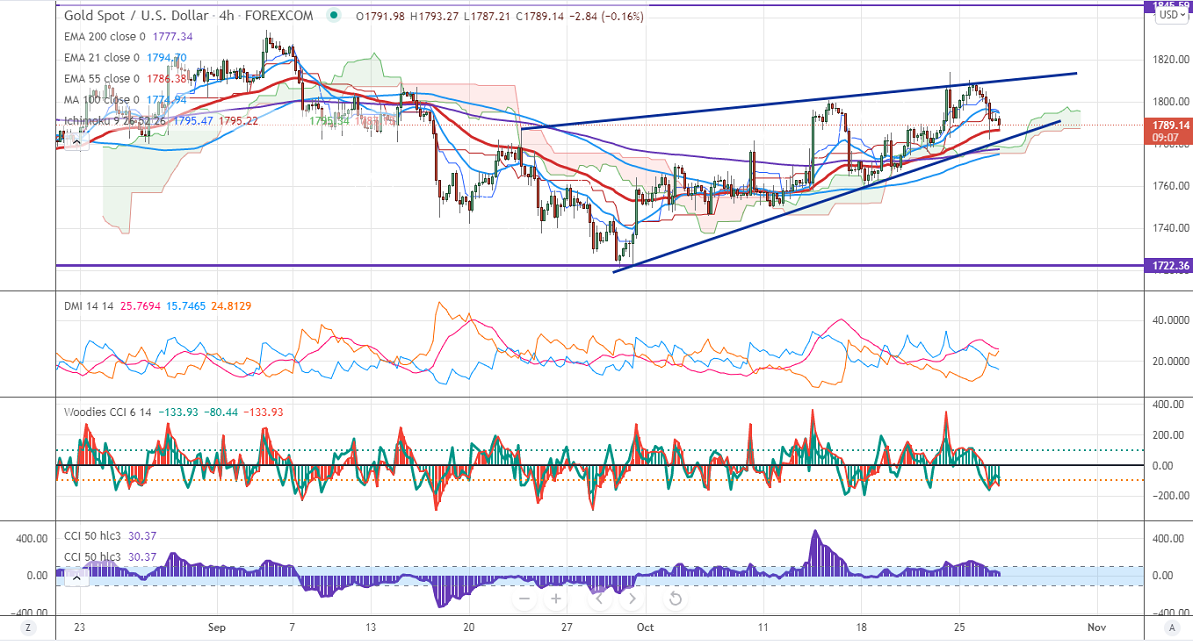

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1796.27

Kijun-Sen- $1795.22

Gold halted its five days of a winning streak and lost more than $20 from a high of $1813. The pullback in the US dollar is preventing the yellow metal from further upside. The US dollar index consolidated in a narrow range between 93.484 and 94.02 for the past four days. Any weekly close above 94.20 confirms bullish continuation.US CB consumer confidence rebounds in Oct to 113.80 compared to forecast of 108.40. While Richmond's manufacturing index rose from -3 to 12. Gold hits a low of $1782.47 and is currently trading around $1789.06.

Factors to watch for gold price action-

Global stock market- Slightly bullish (negative for gold)

US dollar index – Slightly bullish (negative for gold)

US10-year bond yield- bearish (Positive for gold)

Technical:

It is facing strong support at $1778 violation below targets $1770/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1815, any convincing break above will take the yellow metal $1835/$1850/$1860 is possible.

It is good to buy on dips around $1770-71 with SL around $1760 for TP of $1835.