FxWirePro- Gold Daily Outlook

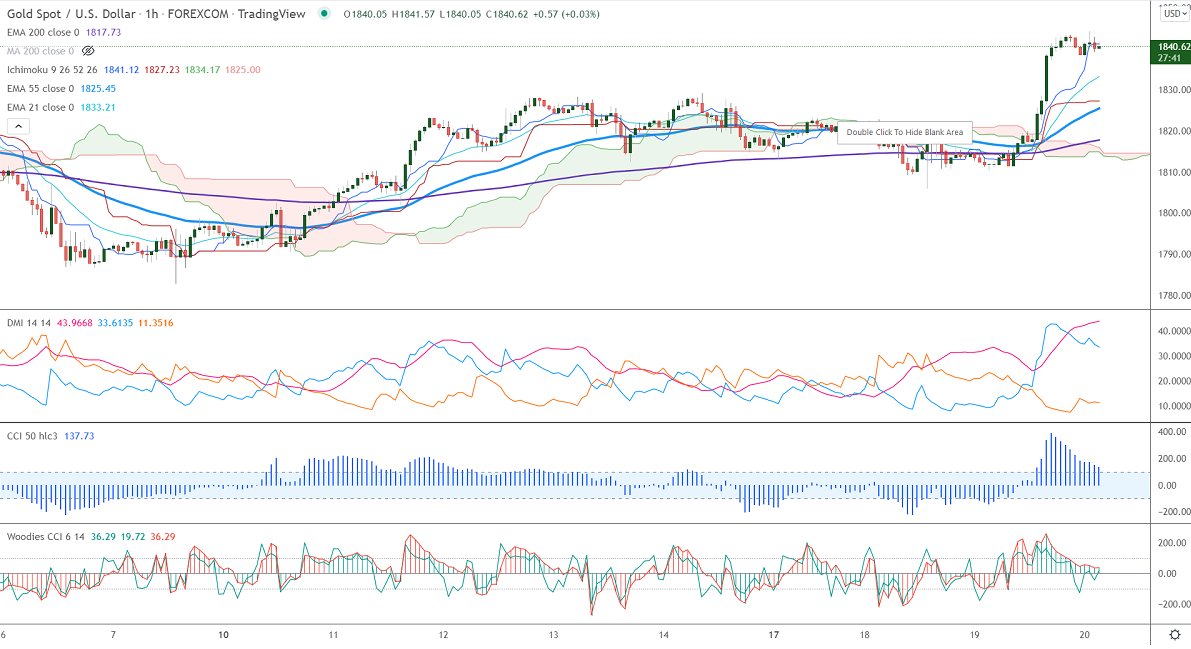

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1841.12

Kijun-Sen- $1827.13

Gold renewed its bullish trend and surged more than $30 on safe-haven demand. The jump in UK inflation and geopolitical tension between Russia and Ukraine also support the yellow metal. The stock market extends its losses for the second consecutive day due to a rise in US treasury yields. The US 10-year yield cooled off slightly after hitting a two-year high. Gold hits a low of $1844 and is currently trading around $1841.13.

The US housing starts rose to 1.70 million in Dec better than the forecast of 1.65 million, the highest level since Mar. Permits for future home building surged by 9% to 1.873 million units in Dec.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (Negative for gold)

Technical:

The near–term support is around $1825, violation below targets $1810/$1780/$1760/$1750. Significant reversal only below $1750.The yellow metal facing strong resistance $1860, any violation above will take to the next level $1877/$1912 is possible.

It is good to buy on dips around $1828-30 with SL around $1818 for TP of $1861.