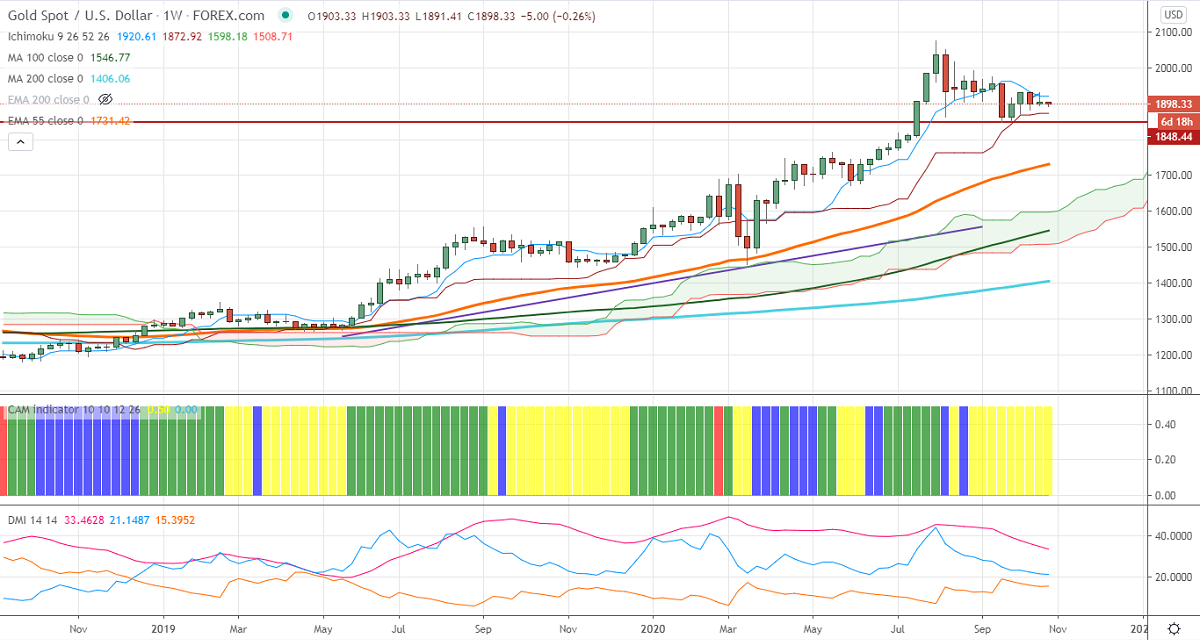

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1920

Kijun-Sen- $1872

Gold is trading weak and hits 11- day low on slight jump in US dollar. The US dollar index has shown a minor recovery of more than 30 pips on an increasing number of new coronavirus cases in the US. Any violation above 93.10 confirms bullish continuation. The US 10-year yield declined nearly 6% after hitting a 4-month high at 0.872%.

Economic data:

The number of people filed for unemployment benefits declined by 55000 to 787000 in the week ended Oct 17 compared to a forecast of 86000. The conference board leading economic activity came at 0.7% slightly less compared to the revised 1.4% in August. US Markit composite PMI index rose to 55.5, the highest level since Feb 2019.

Technical:

In the Weekly chart, Gold is facing strong support near Kijun-Sen at $1872. Any break below will take the pair till $1848/$1830. On the higher side, near term intraday resistance is around $1910 and any indicative break above that level will take the pair till $1933/$1950.

It is good to buy on dips around $1880 with SL around $1868 for the TP of $1920/$1933.