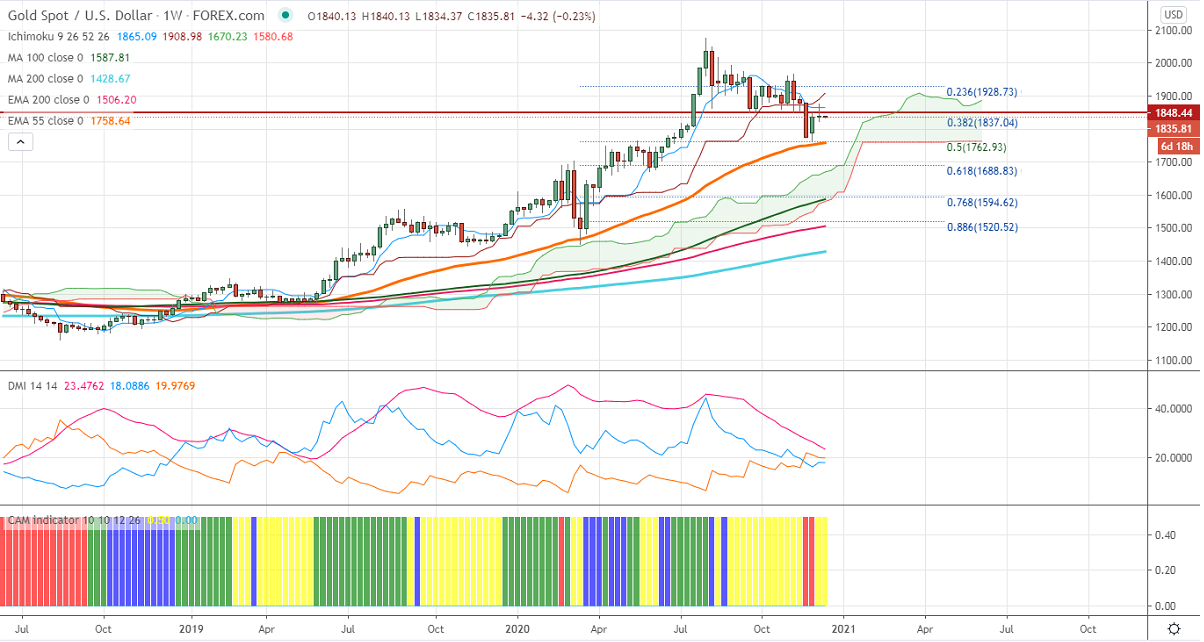

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1865

Kijun-Sen- $1889

Gold has lost more than $50 from the previous week's high of $1875on upbeat market mood. US FDA has cleared Pfizer and BioNtech COVID-19 vaccine on Friday. The demand for Safe-haven assets like yellow metal has declined sharply. The lack of progress in talks on US stimulus is supporting gold at lower levels. DXY continues to trade below 91, violation above 91.50 confirms minor trend reversal. The US 10-year yield lost more than 10% from an intermediate top 0.98%.

Economic data:

The number of people who have filed for unemployment benefits has increased to 853000 compared to an estimate of 725K. US CPI came at 0.2% in November compared to a forecast of 0.1%. The annual inflation unchanged at 1.6%. US Core PPI edged higher by 0.1% compared to 0.2%. While University of Michigan sentiment came at 81.4 vs forecast of 76.1.

Technical:

It is facing strong resistance at $1850, minor bullishness only above that level. Surge beyond targets $1875/$1900.On the lower side, near term support is around $1822, any indicative break below that level will take till $1800/$1765.

It is good to buy on dips around $1825-26 with SL around $1816 for the TP of $1870/$1900.

NZDJPY Pullback: Yen Strengthens on Takaichi's Election Victory – Buy the Dip Toward 96?

NZDJPY Pullback: Yen Strengthens on Takaichi's Election Victory – Buy the Dip Toward 96?