Gold hits 2-week high at $1230 on account of sell-off in global stock market and slight weakness in US 10 year yield.

The major three factors that drive gold prices

US dollar Index: slight weak. DXY has lost nearly 25 pips from yesterday’s high of 96.89. It is currently trading around 96.65.The near term resistance is around 97.08 and any break above targets 97.40/97.70. (slight positive for gold).

USD/JPY: Strong. The pair is trading slightly higher and holding above 113. USDJPY has taken support near 89 day EMA. It is currently trading around 113.02. The near term resistance is around 113.25and any break above targets 113.50/114. Slightly negative for gold.

US 10 year yield : US 10 year yield is trading flat after hitting low of 3.03%.It faces strong support around 3.07 (89- day EMA) .Any further weakness only if it breaks convincingly below 3.07%. It is currently trading around 3.073. neutral for Gold.

US 2 year yield: It has taken support near 89-day EMA and shown a marginal higher. The spread between US 10 year and 2 year has decreased from 30bpbs to 24bpbs.

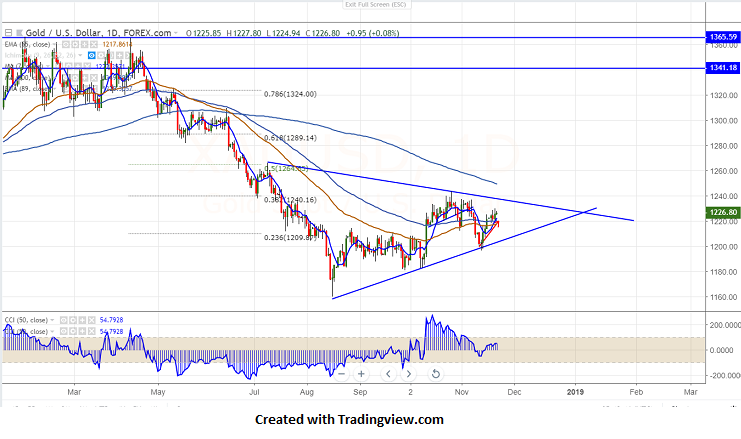

Gold technical

Major support $1183

Major resistance - $1240

The yellow metal was trading marginally higher and jumped more than $10 yesterday.On the higher side, major resistance is around $1230 and any convincing break above $1230 will take the commodity till $1236 .It should break above $1243 (Oct 26th 2018 high) for bullish continuation.

The near term support is around $1217 (55 day EMA) and any violation below will drag the commodity down till $1209/$1200.

It is good to buy on dips around $1223-24 with SL around $1217 for the TP of $1243.