Gold gained sharply as trump paused tariff for 90 days for non-retaliating countries. It hits an high of $3132 yesterday and is currently trading around $3108.

President Trump's April 2025 announcement of a 90-day tariff pause for most countries, but not for China, initially reduced market uncertainty, but the simultaneous raising of tariffs on Chinese imports to 125% raised trade tensions and drove gold prices above 1%. This move, coupled with ongoing trade tensions and potential economic slowdown, has propelled gold's price by over 18% in 2025 as investors seek a safe-haven asset during economic uncertainty driven by Trump's volatile trade policy. Analysts like Edward Meir and Dominic Schnider anticipate the ailing economy and potential Federal Reserve rate cuts to further support higher gold prices owing to sustained inflation fears

Market eyes the US CPI for further direction.

According to the CME Fed Watch tool, the chances of a 25 bpbs rate cut on the June 18th, 2025 meeting have increased to 63.40% from 62.80% a week ago.

Technical Analysis: Key Levels and Trading Strategy

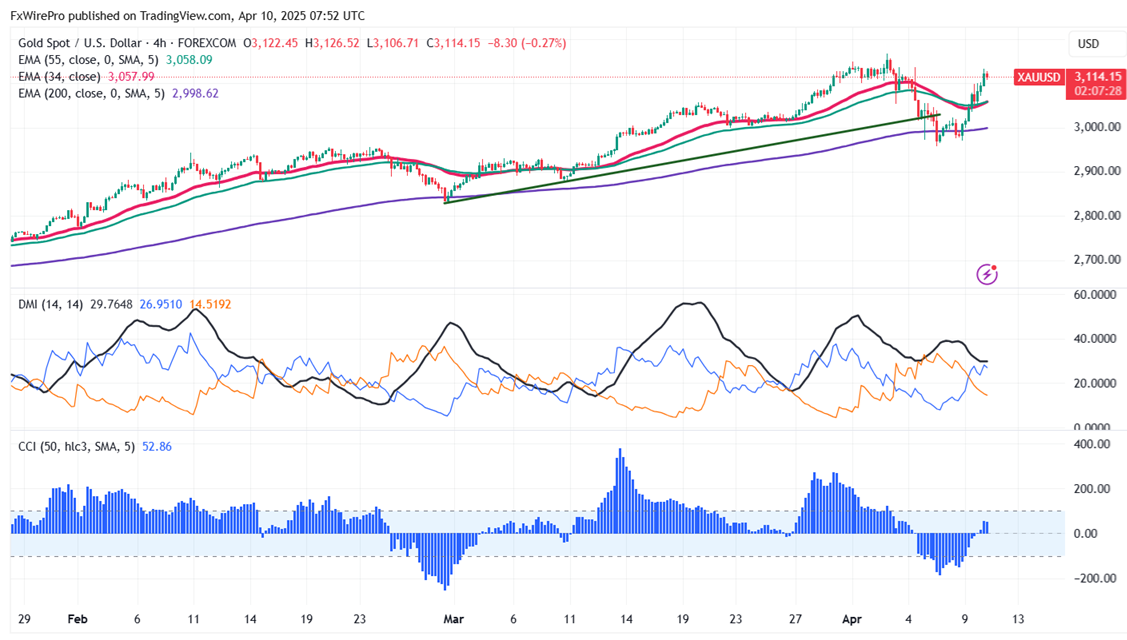

Gold prices are holding below short term moving average 34 EMA and 55 EMA and long-term moving averages (200 EMA) in the 4 hour chart. Immediate support is at $3100 and a break below this level will drag the yellow metal to $3058/$3000/$2956. The near-term resistance is at $3150 with potential price targets at $3167/$3200/$3255.

It is good to sell on rallies around $3138-40 with a stop-loss at $3170 for a target price of $2835.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand