Gold is consolidating narrow range between $1285 and $1294.50 for past three trading days. Markets eye US Non farm payroll data for further direction.

The major three factors that drive gold prices

US dollar Index: Bearish. DXY has shown a minor recovery of more than 30 pips from low of 96.96. The index has formed a minor top around 97.52 and shown minor decline.It is currently trading around 97.23. The index has formed a minor bottom around 95.75 and jumped more than 170 pips .The near term support is around 96.79 and any close below targets 96.36/95.75.(positive for gold).

USD/JPY: Strong . USD/JPY is holding well above 200- day MA for 2 trading days and this confirms minor bullishness a jump till 112/112.20 possible. negative for gold.

US 10 year yield : US 10 year yield continues to trade higher and hits 10 day high around 2.536%. The yield has been trading weak for past two months and lost nearly 25% from high of 3.25%.It is currently trading around 2.51%. Negative for Gold.

US 2 year yield: It is trading around 2.345%. The spread between US 10 year and 2 year has declined to 19bpbs from 30 basis point. The spread between 3 month and 10- year yield inversion has reversed (US 10 year yield trading above US 3 month).

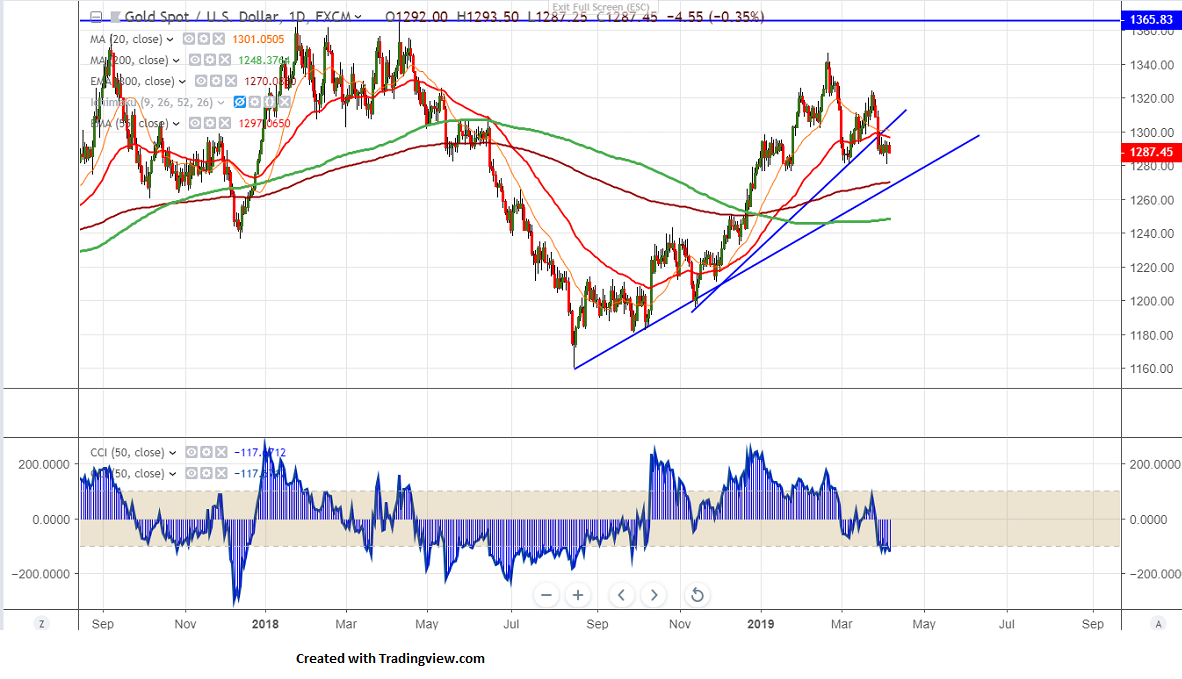

Gold technical

On the higher side, near term resistance is around $1300 and any convincing break above targets $1309/$1312/$1316.The yellow metal should break above $1324 for further bullishness.

The near term support is around $1280 and any convincing below will drag the commodity down till $1269/$1260.

It is good to sell on rallies around $1300 with SL around $1305 for the TP of $1280/$1271