Gold has decline more than $15 after long consolidation on account of easing US-China trade tension. It is currently trading around $1282.

The major three factors that drive gold prices

US dollar Index: strong. DXY is trading higher for 7th consecutive days and and jumped more than 130 pips on account of dovish ECB and Brexit uncertainty. The index is trading above 96.30 (55-day EMA) and a jump till 96.95/97.75.On the higher side any break above 97.75 confirms bullish continuation.(slightly negative for gold).

USD/JPY: weak. USD/JPY has recovered more than 500 pips from low of 104.50. The pair should break above 110 for further bullishness. It is currently trading around 109.55.Slightly negative for gold

US 10 year yield : US 10 year yield is slightly higher and has jumped more than 10% form low of 2.54%.The yield has declined sharply in past two months and lost nearly 22% from high of 3.25%.It is currently trading around 2.78%.Slightly negative for Gold.

US 2 year yield: It is trading around 2.62%. The spread between US 10 year and 2 year has declined to 16bpbs from 30 basis point. The spread between 5 year and 2- year yield has inverted (US 5 year yield trading below US2 year yield).

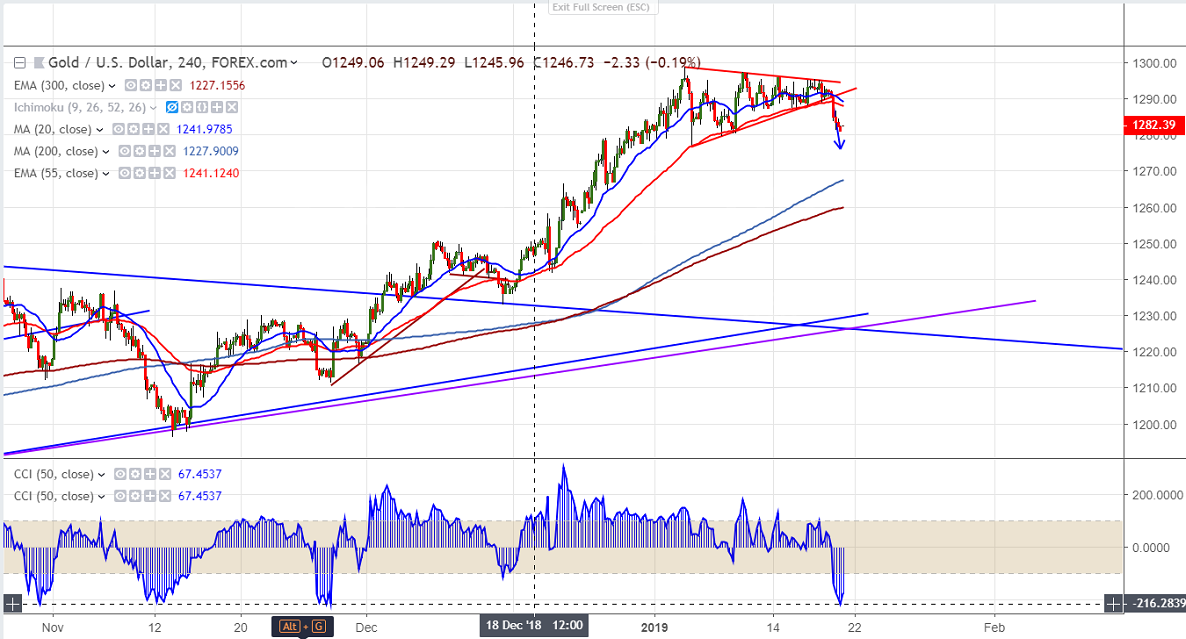

Gold technical

Major support $1183

On the higher side, yellow metal is facing strong psychological resistance around $1300 and break above will take the gold to next level till $1320.

The near term support is around $1281 (20- day MA) and any violation below will drag the commodity down till $1270/$1266/$1252/$1242 /$1234.

It is good to sell on rallies around $1286-87 with SL around $1294 for the TP of $1260/$1250.