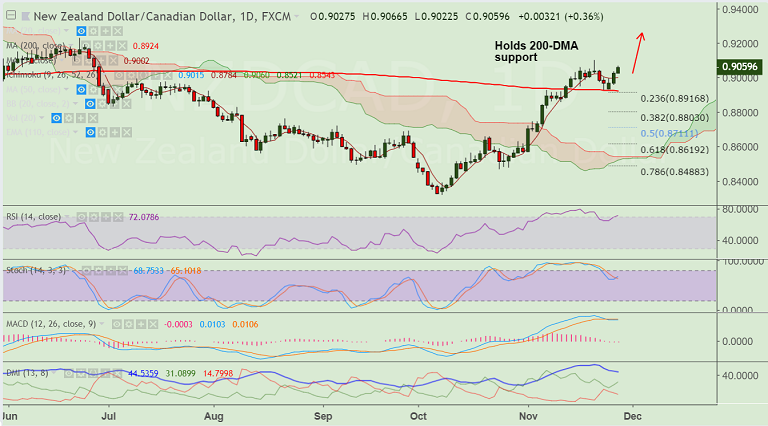

NZD/CAD chart on Trading View used for analysis

- NZD/CAD has bounced off strong support at 200-DMA.

- The pair is now extending gains for the 3rd straight session.

- Upside finds stiff resistance at 200W SMA at 0.9077. Break above required for further gains.

- Momentum strongly bullish on the daily charts. Technical studies are turning bullish on weekly charts.

- Impressive upside economic surprises from New Zealand, such as jobs/CPI and GDP likely to support the kiwi.

- While on the other side oil trades cautiously ahead of OPEC meeting next week.

- Breakout at 200W SMA to see test of 0.9227, while we see weakness till 0.88 on break below 200-DMA.

Support levels - 0.9002 (5-DMA), 0.8924 (200-DMA)

Resistance levels - 0.9077 (200W SMA), 0.9227 (June 2018 high)

Recommendation: Watchout for break above 200W SMA to go long, target 0.9225

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts