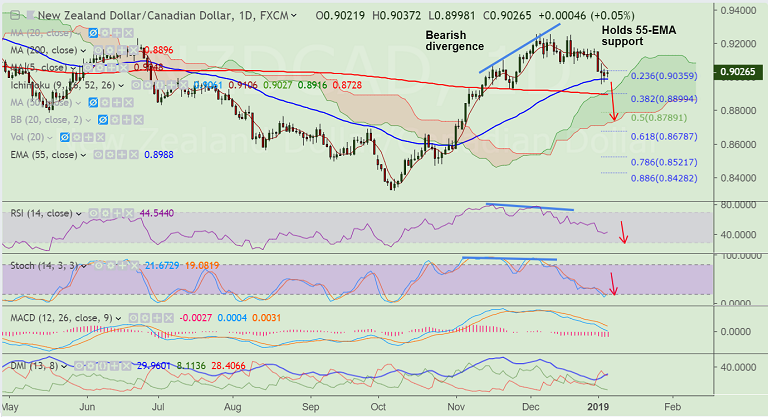

NZD/CAD chart on Trading View used for analysis

- NZD/CAD extends range trade at 55-EMA support.

- Positive news related to the US-China trade war alongside China's announcement of more stimulus measures coming from the banking sector support antipodeans.

- Back-to-back spinning top formations suggest lack of direction.

- Price action has slipped below 21-EMA support and bearish divergence on RSI and Stochs keeps bearish bias.

- Upside lacks traction, doji formation seen on daily candle. Immediate resistance lies at 5-DMA. Break above to see minor upside.

- Break below 55-EMA to see dip till next bear target at 200-DMA at 0.89. Violation there will see test of 61.8% Fib at 0.8678.

Support levels - 0.8988 (55-EMA), 0.89 (converged 200-DMA and 38.2% Fib), 0.8789 (50% Fib), 0.8678 (61.8% Fib)

Resistance levels - 0.9048 (5-DMA), 0.9087 (21-EMA), 0.92, 0.9256 (Dec high)

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes