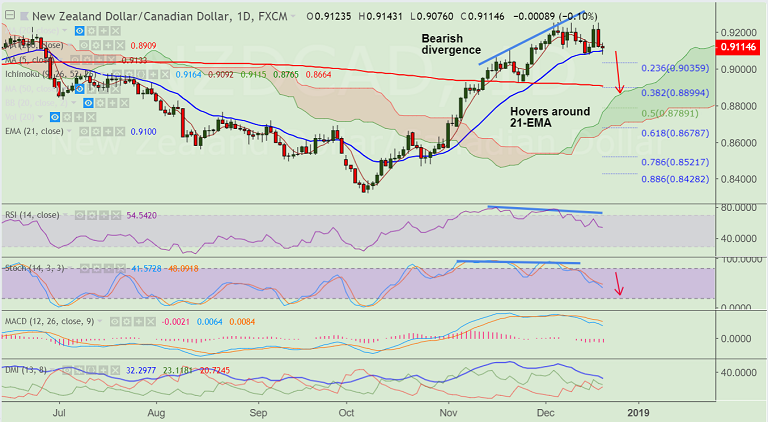

NZD/CAD chart on Trading View used for analysis

- NZD/CAD has retraced dip below 21-EMA support, bias remains bullish.

- The pair is trading lagely muted at 0.9116 at the time of writing. kiwi dented on dismal NZ Q3 GDP and risk-off market profile.

- Data released earlier today showed New Zealand Q3 GDP arrived at +0.3% q/q vs the 0.6% expected and 1.0% in Q2.

- For the y/y, GDP was up 2.6% missing forecasts at 2.8% compared to 3.2% prior, revised up from 2.8%.

- Technical indicators are biased lower for the day and bearish divergence on RSI and Stochs keeps scope for weakness.

- Break below 21-EMA to see dip till 23.6% Fib at 0.9035. Further weakness will see test of 200-DMA at 0.89.

Support levels - 0.91 (21-EMA), 0.9035 (23.6% Fib), 0.89 (200-DMA)

Resistance levels - 0.9133 (5-DMA), 0.92, 0.9270 (Upper BB)

Recommendation: Watch out for decisive break below 21-EMA to go short.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields