Refer NZD/CHF chart on Trading View

FxWirePro Currency Strength Index for NZD/CHF: Bias Slightly Bullish

FxWirePro's Hourly NZD Spot Index was at 119.005 (Bullish)

FxWirePro's Hourly CHF Spot Index was at -89.8522 (Bearish)

Technical Indicators: Bias Turning Slightly Bullish

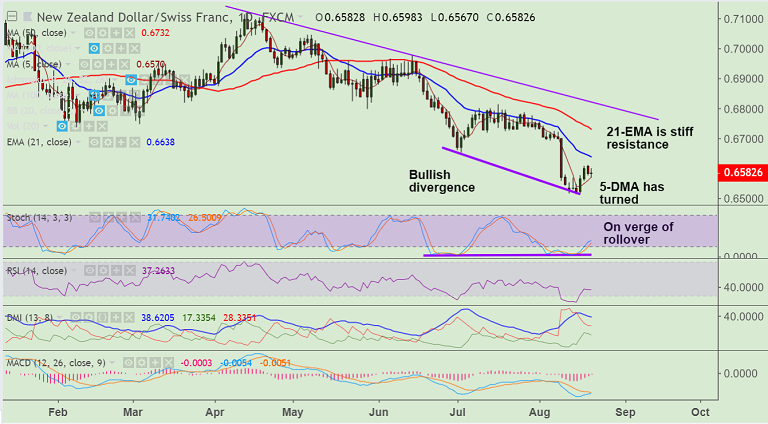

- Bullish divergence on Stochs and CCI

- Stochs are on verge of rollover from oversold

- MACD is on verge of a bullish crossover on signal line

- 5-DMA has turned and downside holds support at 5-DMA

Analysis:

- Major trend is bearish, signs of minor pullback seen

- 21-EMA is stif resistance. Break above could see extension of upside

Support levels - 0.6570 (5-DMA), 0.6512 (Aug 15/16 low)

Resistance levels - 0.6638 (21-EMA), 0.6732 (50-DMA)

Recommendation: Stay long on break above 21-EMA, target 0.6730/ 0.6775/ 0.68

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: NZD/CHF Technical Outlook

Tuesday, August 21, 2018 9:49 AM UTC

Editor's Picks

- Market Data

Most Popular