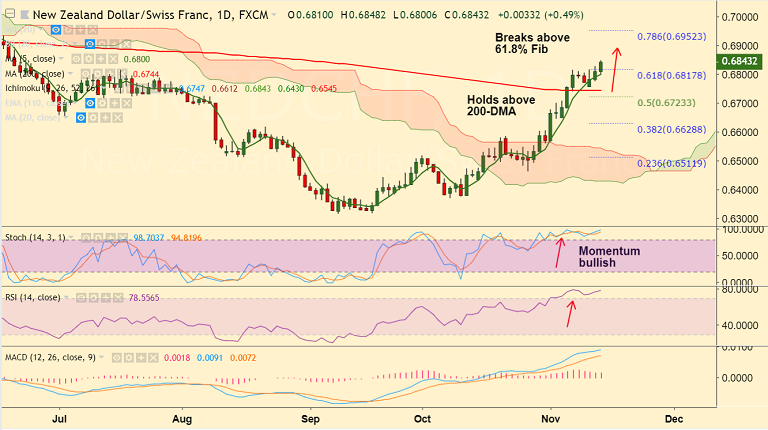

NZD/CHF chart on Trading View used for analysis

FxWirePro Currency Strength Index for NZD/CHF: Bias Bullish

FxWirePro's Hourly NZD Spot Index was at 123.296 (Bullish)

FxWirePro's Hourly CHF Spot Index was at -65.2704 (Neutral)

Technical Analysis: Bias Bullish

- Price action holds above 200-DMA support and is above daily cloud and major moving averages

- Momentum studies are bullish, RSI and Stochs are sharply higher

- MACD supports upside, we see +ve DMI dominance

- Pair has broken above 61.8% Fib after brief consolidation

Support levels - 0.6817 (61.8% Fib), 0.68 (5-DMA), 0.6744 (200-DMA)

Resistance levels - 0.69, 0.6952 (78.6% Fib)

Recommendation: Good to stay long on dips, SL: 0.68, TP: 0.69/ 0.6950

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: NZD/CHF Trade Idea

Wednesday, November 14, 2018 11:49 AM UTC

Editor's Picks

- Market Data

Most Popular

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms