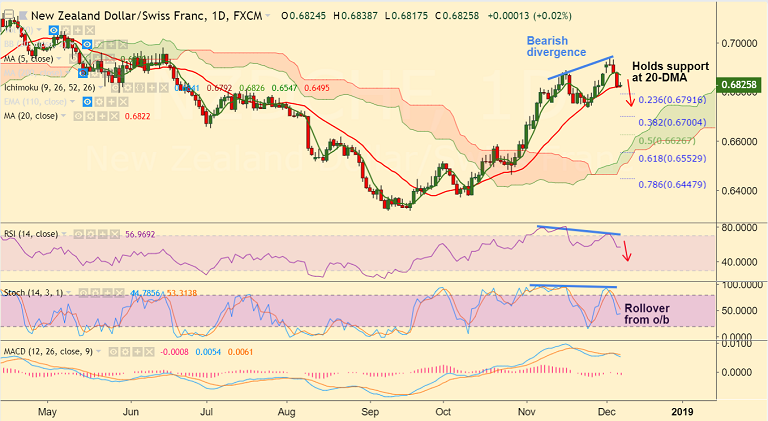

NZD/CHF chart on Trading View used for analysis

- NZD/CHF pauses downside at 20-DMA support at 0.6822, bias bearish.

- Technical indicators support weakness. Price was rejected at highs with a Gravestone Doji formation on 4th Dec.

- The pair has been extending weakness since and has fallen below 5-DMA.

- 5-DMA has turned lower and Stochs have rolledover from overbought levels, RSI is biased lower.

- Bearish divergence on RSI and Stochs adds to bearish bias. Break below 20-DMA to see extension of weakness.

- Next major support below 20-DMA lies at 23.6% Fib at 0.6791. Further weakness will see test of 200-DMA at 0.6744.

Support levels - 0.6791 (23.6% Fib), 0.6744 (200-DMA), 0.67

Resistance levels - 0.6870 (5-DMA), 0.6919 (Upper BB), 0.6939 (Dec 4 high)

Recommendation: Good to stay short on upticks, SL: 0.6885, TP: 0.6815/ 0.6745

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-CHF-Trade-Idea-1468976) has hit TP1.

Recommendation: Book partial profits, stay short for further downside.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close