NZD/CAD chart on Trading View used for analysis

- NZD/CAD has bounced off 55-EMA support with a spinning top formation.

- Antipodeans edge higher after China's upbeat Caixin Services PMI reading.

- China's Caixin Services PMI for December improved to 53.9, beating forecasts at 52.9.

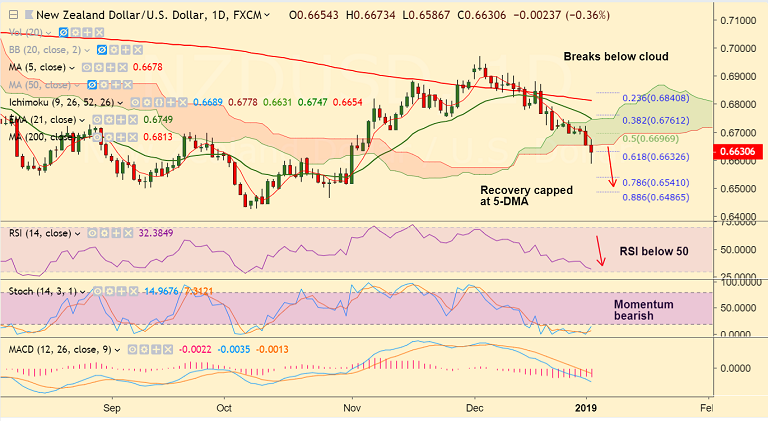

- Price action has slipped below 21-EMA support and bearish divergence on RSI and Stochs keeps bearish bias.

- Upside lacks traction, doji formation seen on daily candle. Immediate resistance lies at 5-DMA. Break above to see minor upside.

- Break below 55-EMA to see dip till next bear target at 200-DMA at 0.89. Violation there will see test of 61.8% Fib at 0.8678.

- On the flipside, retrace above 21-EMA could see further upside.

Support levels - 0.8987 (55-EMA), 0.89 (converged 200-DMA and 38.2% Fib), 0.8789 (50% Fib), 0.8678 (61.8% Fib)

Resistance levels - 0.9074 (5-DMA), 0.9095 (21-EMA), 0.92, 0.9256 (Dec high)