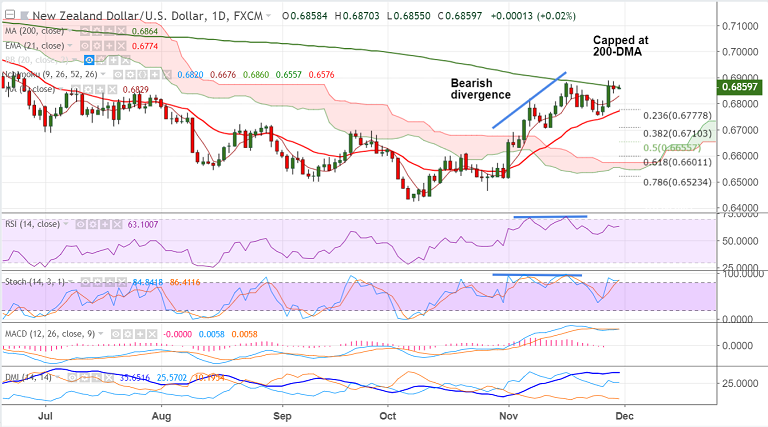

NZD/USD chart on Trading View used for analysis

- NZD/USD extends range trade for a second straight session, intraday bias neutral.

- Caution prevails ahead of this weekend’s key meeting on trade between the US President Trump and his Chinese counterpart Xi.

- The bullish momentum has continued fading and we see and increasing risk of a downward extension.

- 200-DMA is major resistance at 0.6864 and any further upside only on breakout above.

- We evidence a bearish divergence on RSI and Stochs which adds to the bearish bias.

- Data on Thursday showed US core PCE inflation increased less-than-expected in Oct, by 1.8% YoY, while unemployment claims were up 234K in the week ended November 23.

- On today's macroeconomic calendar focus will be on US Chicago PMI, expected at 58.0 from the previous 58.4.

Support levels - 0.6830 (5-DMA), 0.6792 (20-DMA), 0.6774 (21-EMA)

Resistance levels - 0.6864 (200-DMA), 0.6887 (Nov 28 high), 0.69

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data