Asian markets is trading slightly lower with Nikkei declined more than 0.50%. The sell-off was mainly due to depreciation of Japanese yen and weak US markets .The downgrade of global growth by IMF said that global economy will grow at 3.7% slightly less than earlier forecast of 3.9%. Shanghai composite is still in selling mode and trading lower after a minor jump . It is currently trading around 2714 0.23% lower

USD/JPY `has shown a selling of more than 150pips after hitting 11 year high of 114.54.The pair is trading at 113 and a break below 112.80 (20- day MA) confirms intraday weakness.

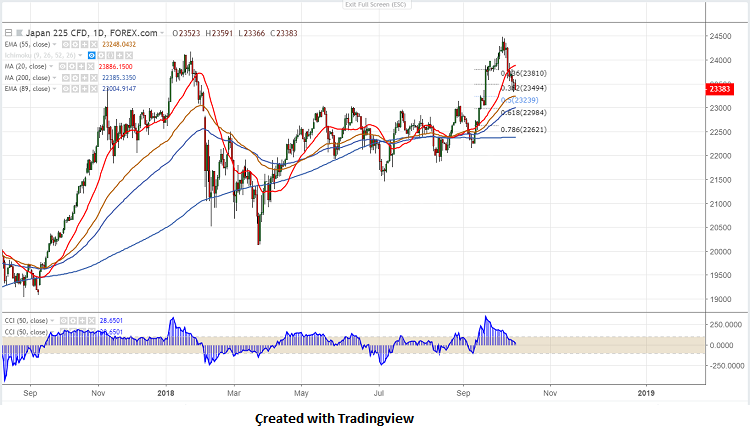

On the lower side, near term support is around 23250 (55- day EMA) and any break below 22996 (89- day EMA)/22621/22382 (200- day MA).

The near term resistance is at aid 23600 and any break above targets 23870 (20- day MA)/24000/24280.

It is good to sell on rallies around 24200-225 with SL around 24500 for the TP of 23500/23000