Asian markets is trading flat to negative following footsteps of Wall Street . US markets closed slightly lower with Dow Jones at 25983 (0.77% lower) and S&P500 at 2781 (0.92% lower).Chinese market shanghai is trading higher and lost almost 0.67% higher and is trading around 2610 0.97% lower.Nikkei has jumped more than 300 points from low of 22015. It is currently trading around 22300 (0.84% higher.

USDJPY hits 5-week high at 114.08 and is hovering around this level. The near term major resistance is around 114.25 and any break above targets 114.55. It is currently trading around 113.86.

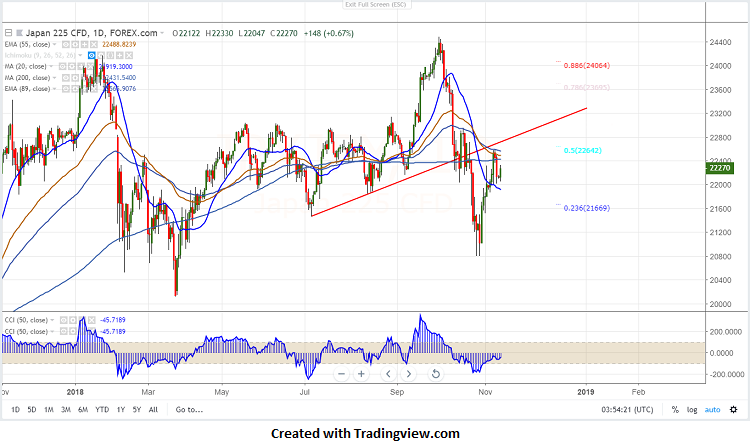

On the lower side, near term support is around 21990 (20- day MA) and any break below targets 21800/21500.

The near term resistance is at aid 22600 and any break above targets 23000/23280..

It is good to buy on dips around 22250-300 with SL around 2200 for the TP of 22800/23000.