On the macro side, with the chorus of hawkish commentary by the Fed officials, the market has priced in a March hike immediately. Given that, widening U.S.-Japan yield spreads have brought USDJPY higher and the pair is now reaching the upper end of its trading range since mid-January. We now expect the Fed to deliver three hikes in this year (Mar, Jun, and Sep vs. May and Sep previously).

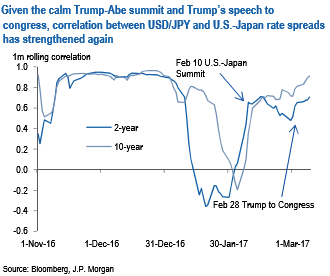

One important assumption of our bearishness on USDJPY is that a correlation between the pair and U.S.-Japan yield spread collapses with heightening concerns on political risks. Although it was the case early this year, the correlation has strengthened again as the U.S.-Japan summit and Trump’s speech to Congress passed without any troubles (refer above chart).

As a more harmonic U.S.-Japan relationship and a more aggressive Fed stance would mitigate downside risks to USDJPY to some extent, we revised USDJPY forecasts for end-June, end-September, and end-year to 111, 108 and 105 from 105, 102 and 99 respectively. We target 105 at end-March next year.

As the new profile suggests, however, we think factors mentioned above would not be influential enough to get USDJPY on a solid upward path heading to 120 or even higher, and still, expect it to track a modest downward trend in the medium-term.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook