Hedging USD/JPY has been quite baffling as the pair shows indecision on either direction as the formation of four priced doji candlestick pattern occurred at 123.382 levels on EOD charts, this reflects the highest extent of indecision between bulls and bears as there was also 3 white soldier pattern occurred before.

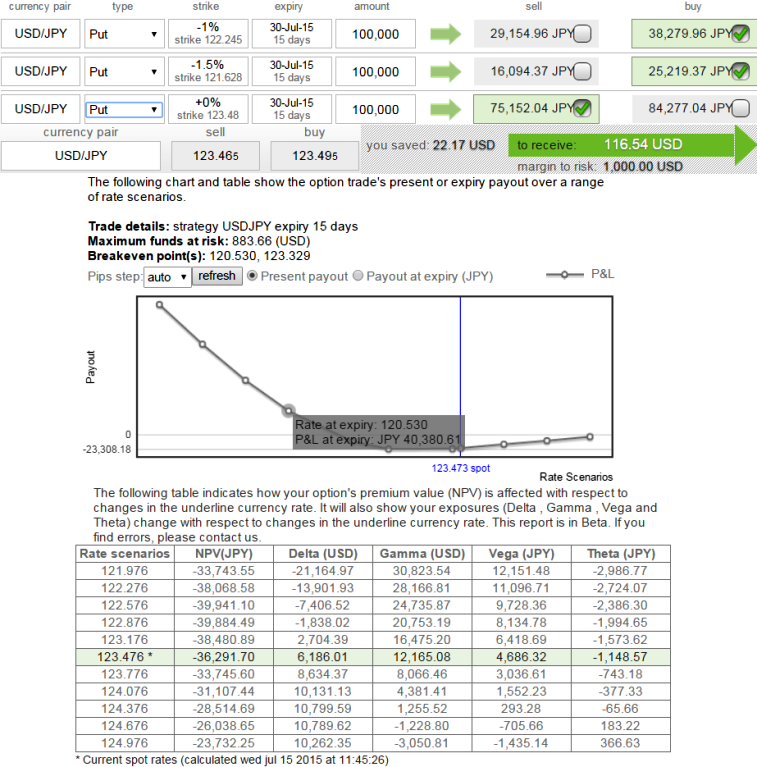

Even though reversal trend is indicated earlier, anyone who expects opposite directional moves in this pair can arrest short-medium term downside risks of USDJPY hedging through deploying option strategy: Put Ratio Back Spread

Expect the underlying currency cross USDJPY to make a reasonable move on the downside in medium terms.

For short term hedgers the recommendation would be; Purchase (1%) OTM puts and sell fewer puts of a higher strike (ATM or ITM) usually in a ratio of 2:1 or 3:2.

This is more attractive strategy, basically, as you're selling an at-the-money short put spread in order to help pay for the extra out-of-the-money long put.

The higher strike short puts finances the purchase of the greater number of long puts and the position is entered for no cost or a net credit.

Keep an adequate time for maturity so as to make a substantial move on the downside.

FxWirePro: Put Ratio Back Spread for hedging USD/JPY downside risks

Wednesday, July 15, 2015 6:20 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary