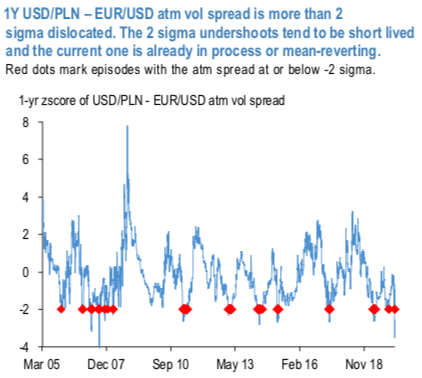

EURUSD vols have been a notable casualty of the recent market gyrations resulting in USDPLN – EURUSD ATM vol spread at 2-sigma low (basis 1-yr lookback window), a defensive dislocation worth fading, given the attractive risk/reward for buying a higher beta vol at a tight premium. Historically, such undershoots tend to be short lived, although catching the right timing can prove challenging (refer 1st chart).

2nd chart beta-to vol analysis indicates PLN to be a strong buy which in conjunction with the USDPLN - EURUSD vol backdrop allows for entering a defensive long high beta / short low beta vol spread that should hold well, given the favorable entry level.

We back-test a simple trade timing strategy of initiating long USD/PLN vs. short EURUSD at times when their vol spread drops below -2 sigma on 1-yr z- score. The red dots in 1st chart mark the entry points. The analysis shows the bulk of P/L coming within first two weeks and peaking around the 1-month mark with the distribution of the historical returns displaying favorably fat right tails, in line with the long high beta / short low beta characteristic of the vol spread.

Fading the current 2 sigma dislocation, should have potential of producing 1.5-2 vol of P/L. The real nugget is in the fat right tail characteristic that historically tend to align particularly well with the late cycle dynamics. If late cycle is to take hold more forcefully, the vol spread could realize 4-5vol of P/L. Front tenors are the preferable expression but the current liquidity conditions force tenor extension: Long 1Y USDPLN delta-hedged straddle @9.55/10.75 vs short EURUSD delta-hedged straddle @8.35/9.05, in equal vega notionals. Courtesy: JPM

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025