JPY to strengthen vs CNY, with initial target of 15.00.

USD/JPY drop is likely limited to 110 given likelihood of intervention.

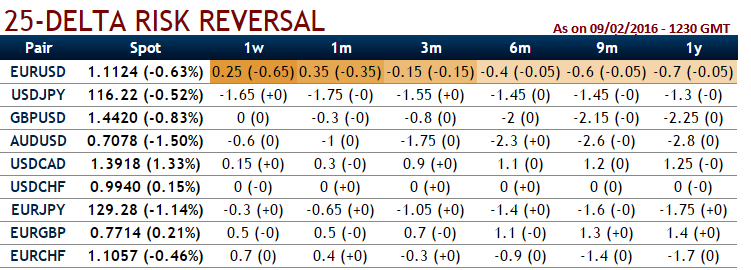

EUR and JPY risk-reversals have fared much better than USD ones as risk hedges. Current valuations suggest that EUR/high beta RRs are rich however, while EUR/CHF RR is a value buy.

The current spot FX of USDJPY is trading at 114.854, we would still expect more dips extending up to 109.915 in near terms. So, it is understood that bearish momentum is bolstering as we saw that from delta risk reversal table in the previous post as well. Hence, aggressive bears can initiate strategy using ATM puts.

Buy USD/JPY 2m ladder strikes 115.5/114.5/109.

Yen's gains against euro can't be spared aside, unlike a simple naked put, put back spreads have an extra-long that has not only leveraging effects, a short option at a lower strike that caps your reward but also reduces the net cost of the trade.

So, the recommendation for EURJPY is to continue with an extra-long on put with 1W expiry to the existing debit put spreads. In lieu of 2:1, bears can eye on 3:2 ratio in the spread for leveraging effects. Stay short in 4D ATM put and 2 lots of long in 2M OTM delta puts.

Caution: If you think the pair is going to crash, you should be loading up on put buys in existing strategy. The total cost of the trade is going to be the difference between the prices of the two options.

Since the option you sell will always be lower on the skew curve it means you are getting a better deal on what you are selling compared to what you are buying. It makes this strategy a good one if the skew is running a little hot but EURJPY hasn't rolled over that much.

FxWirePro: Risk reversals of Yen’s crosses signal more bearish sentiments – hedging perspectives

Tuesday, February 9, 2016 6:24 AM UTC

Editor's Picks

- Market Data

Most Popular