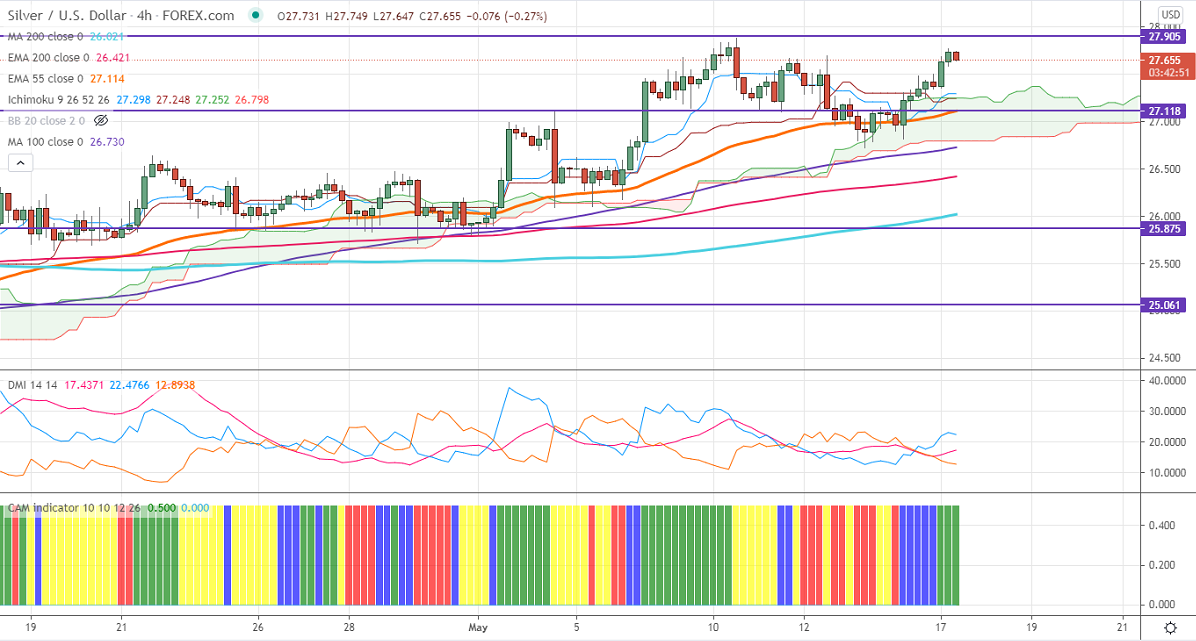

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $27.29

Kijun-Sen- $27.24

Silver jumped sharply more than $1 in the past two days from a low of $26.72. The minor sell-off in US dollar and US bond yields due to weak economic data is supporting the precious metal. US retail sales came unchanged at 0.0% in Apr compared to a huge jump of 10.7% the previous month. The core retail sales dropped to -0.8% vs an estimate of -0.5%. The University of Michigan consumer sentiment for Apr came at 82.8 much lower than the forecast of 90. The US 10-year bond yield lost more than 5% from a high of 1.705%. The US dollar index is trading below 91 levels. Any violation below 90 confirms trend continuation. It hits an intraday high of $27.77 and is currently trading around $27.42.

Technically, silver's significant support is around $27.50, violation below will drag the pair down to $27/$26.69/$26/$25.60. Significant bearishness can be seen only if it breaks below $24.60.The near-term resistance is at $27.88, any surge past targets of $28.35/$29/$30 is possible.

Indicator (4-Hour chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around $27.50 with SL around $26.59 for TP of $28.