Keeping both fundamental and technical aspects in mind, in the interest of speculators we see buying opportunities in binary calls at every dips for a target of 122.80 levels.

Hedgers should focus on better bear spreads that offers optimal entry points.

Derivatives Insights:

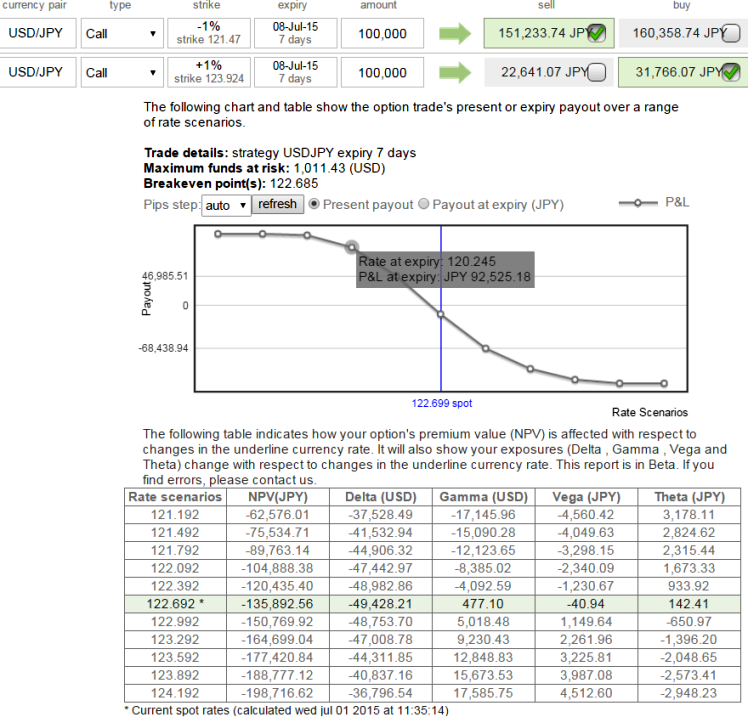

Option Strategy: Credit Call Spread

In order to establish the above stated strategy, hedgers should focus on selling a Call option and purchase another Call at a higher Strike Price for a net credit.

A Bear Call Spread is better over short Call since it has limited risk unlike unlimited risk in case of short call.

Use a short time for maturity (something like 15 day to near month contracts bearing positive theta value) to take advantage of the time decay and give the underlying currency less time to go against you.

Buy 7D (1%) Out-Of-The-Money 0.25 delta calls and sell 7D (-1%) In-The-Money calls for net credit receivable. The combined delta should have negative delta somewhere close to 0.5 as we have shorts on ITM calls in our position.

FxWirePro: Speculate USD/JPY using Binary contracts but spreads for hedging on gap-down pattern

Wednesday, July 1, 2015 6:17 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings