In this write-up, we run you through the forward election vols hedges. The political risk is returning to the spotlight as one possible driver capable of breaking the fragile state that global economy lies in at the moment. Since the Brexit referendum and the 2016 US election, the two major upsets during the turbulent 2016, FX option markets have been touchy historically about the issue of political event risk premium.

The upcoming 2020 US election pricing are gearing-up to be one of the most eventful in history and the notable uptick in FX options pricing of that risk since the impeachment developments comes at the 13 months mark before the election day, well ahead of any of the previous elections.

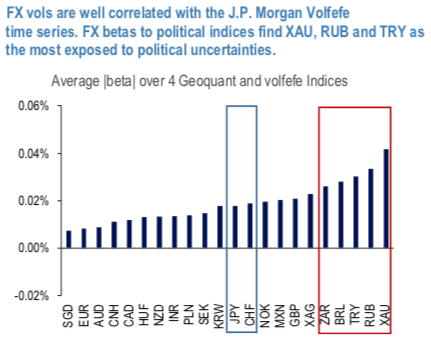

The market impact of political noise has been on the rise prompting us to look into sensitivity of FX to the political risk proxy: 1) Geoquant (Bloomberg ticker: GEOQUSPR) and 2) JPM’s Volfefe. The Geoquant indices aggregate several indicators that proxy political risk for different countries, whereas the Volfefe Index applies a Machine Learning (Random Forest) technique for gauging the probability that US President Trump tweets can have a market moving impact on the US rates market.

3M FX vols display good correlation with the two indices with the betas of the daily FX % changes against the % change in the indices (1st chart) identifying XAU, RUB, TRY and BRL as the most reactive overall and JPY and CHF among the G10.

Even after the September 15vol jump in overnights pricing of the US 2020 election all the way up to 35vols, USDJPY election vol strikes us as still a good value considering:

1) 20-vols of upside, 2) the level of potential political noise and the corresponding election tail risks that await next year and 3) liquidity constrains that plague other candidates.

While the OT calendar spreads for under-priced primaries: Only a touch off the multiyear low, sub 1y yen vols screen attractively as a broad-based risk hedge for the under-priced noise from 1H 2020 primaries. The JP Morgan’s macro analysts are of opinion that near term yen is vulnerable to a limited pullback, the notion that is reinforced by the length of yen IMM positioning. Amid such backdrop yen gains should come at a slow pace which along with the fairly flat vol surface and potential for the 1H primaries vol pricing to start reflecting higher event risk motivates calendar spreads.

Short 3M / long 6M USDJPY one-touch put calendar earns 23% of static carry at 3m holding for strikes @105 (more than 3 big figures under the current spot) and has max payout of 5.8X. Alternatively, consider gold, which has one of the highest beta to political noise, per the above chart. The analysts see it at 1660 in1Q’2020 and 1710 in 2Q’2020 but the spot has been stuck at around 1500 handle. Short 3M / long 6M gold call @1580 strike shows 3m static carry of 25%, which seems very attractive to us as a longer term defensive stance that utilizes the 1500 sticky level. High TV strikes are appropriate in an environment of directionless spot or weak trends, as currently the case for both yen and gold.

Hence, consider the positive theta, high leverage structures that target 3M-6M fwd vols uptick:

Short 3M vs long 6M USDJPY 105 strike one-touch put calendar @16/17 %USD, spot ref 106.4.

Short 3M vs long 6M XAUUSD 5% OTM strike one-touch call calendar @12.5/16.5 %USD. Courtesy: JPM

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One