We recommend buying SAGB 8.75% 28-February-2048 bonds, which are currently trading at a yield of 9.69%. The position is FX-unhedged, with USDZAR at 13.37. We place a stop loss at a 9.99% yield level and a target of 8.94%. The trade generates carry of +22bp per month, inclusive of funding costs. Our trade horizon is 6-9 months.

Medium-term dynamics bode well for South Africa: Despite the fraught political situation in which South Africa currently finds itself post last night’s cabinet reshuffle, we note that dynamics past the immediate horizon favour outperformance in the country’s assets.

In the first instance, President Zuma’s cabinet reshuffle may have accelerated his own political demise. Already, the main opposition party Democratic Alliance has submitted a no-confidence motion against Zuma.

Meanwhile, the Economic Freedom Fighters have applied to the Constitutional Court to instruct Parliament to initiate impeachment proceedings against Zuma for lying before Parliament. The destructive Zuma complex may spiral into a tailspin; one way or another, Zuma will soon exit South Africa’s political scene. Even if these efforts to eject Zuma before the natural end of his tenure prove unsuccessful, they may put increased pressure on the more corrupt elements of the ANC, and drive voters toward more reform-minded government.

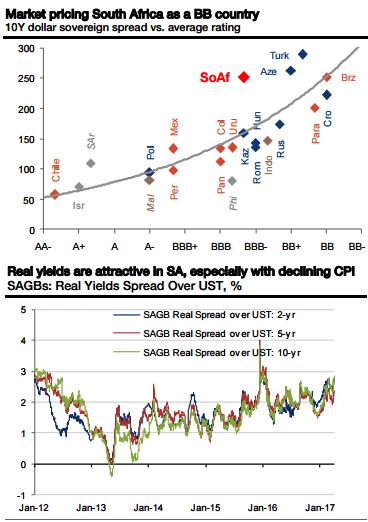

More importantly, global markets remain favorable toward EM: a dovish Fed, a retreating USD, the glacial pace of policy normalization from developed market central banks, and improving EM macro fundamentals underpin the appeal of high-yielding EM assets. Additionally, domestic economic data are improving in South Africa, with the current account deficit shrinking, inflation ticking lower, and commodity prices stabilizing. Post this morning’s sell-off in South African assets, the market is already pricing in a 2.2-notch downgrade in the country’s credit ratings.

Although we believe sovereign rating downgrades are likely over the near term, we do not anticipate substantial further market upheaval when / if they materialize, relative to current valuations.

Adverse global factors can further political fall-out can impair trade Further adverse political developments may impair trade performance, such as intra-ANC fractures that lead to a governmental paralysis.

Additionally, external global factors that damage EM risk sentiment can also undermine the trade, such as rapid monetary policy tightening in developed markets, political turmoil in the US/Europe, and renewal of fears from Chinese growth.

Negative domestic economic news-flow such as resurgent inflation can also push long-dated government bond yields higher.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?