There has been a complete de-coupling of the AUDNZD FX pair from relative rates, despite a strong correlation in recent years. Why does the kiwi fly so high? There’s nothing wrong with growth (around 2.7% this year), but it will still in all likelihood be softer than in Australia.

The big driver is a move away from relative rates/yields and to absolute yields as a driver of NZD appeal. In a very low yield world, the value of the incremental yield on offer in NZD is worth more than it used to be and the status as highest yielding G10 currency has additional value.

Maybe this keeps NZD supported for a while, but any upward pressure on yields globally risks showing up in NZD more than in other currencies.

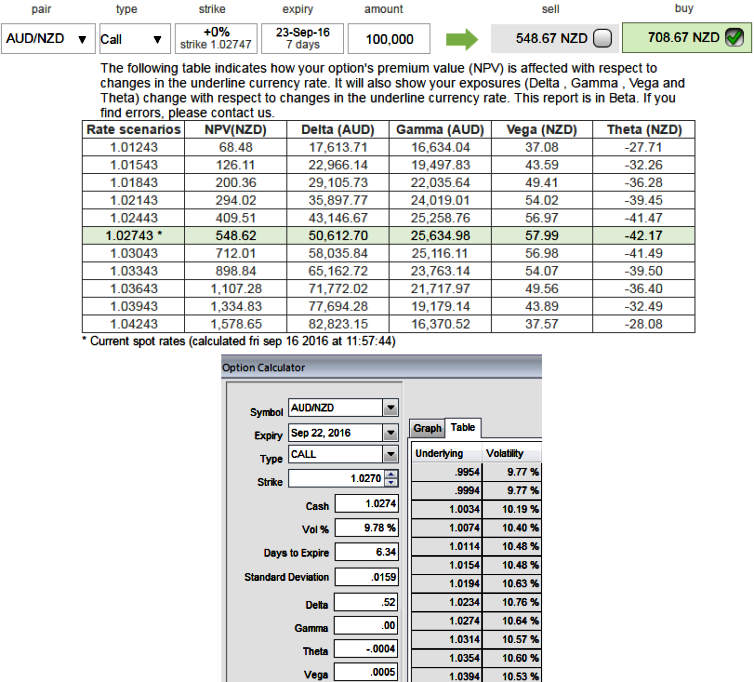

1w ATM implied volatilities of AUDNZD is shy above 9.75%, whereas the ATM call premiums of the same tenor are overpriced at 29% more than net present value. Hence, avoid ATM calls to stay long in this pair. Alternatively, one can also use synthetic long call position that is created when the long stock position is combined with a long put of the same series. Or writing OTM puts would serve speculative motives.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary