The US labor market report today is the first important indication of how the second wave of Covid-19 pandemic is affecting the economic recovery in the US. It is generally expected that the rise in employment has slowed considerably in July. However, there is significant uncertainty as to how much it has slowed. Certainly, the ADP report, which signalled only roughly 170k new jobs in July following 2.4 million the previous month, was not a good indication. On the other hand this particular indicator has not been very reliable recently so that today’s data entails considerable potential for a surprise to the up- and downside.

The GBP has risen against the weaker USD but is prone to disappointment as UK-EU trade talks are deadlocked. The US dollar has risen modestly overnight but remains close to recent range lows against both the euro and sterling. The pound was supported by a Bank of England statement that seemed to suggest that a near-term move to negative interest rates was unlikely. It has slipped back below 1.3150 against the US dollar this morning.

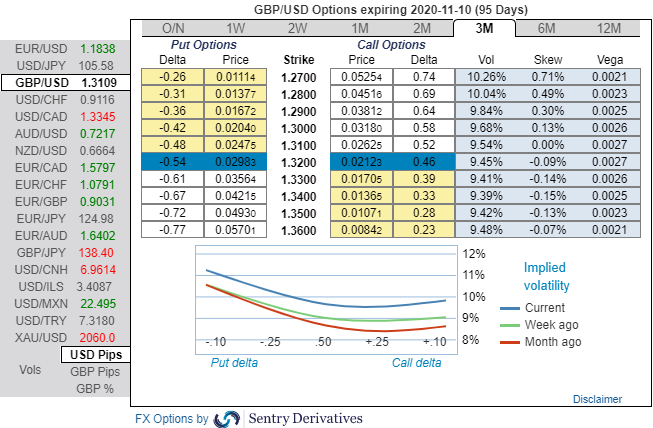

Options Strategy (Debit Put Spread): Contemplating above factors, we wish to deploy diagonal options strategy by adding short sterling: Stay short a 2M/2W GBPUSD put spread (1.3210/1.27), spot reference: 1.3109 level.

The Rationale: Observe the 3m GBP’s positive skewness that has stretched towards OTM Put strikes upto 1.27 levels, hence, options traders are expecting that the underlying spot FX to slide southwards.

While risk reversal numbers have still been signalling bearish hedging sentiments in the long run. One can observe fresh positive bids to the existing bearish setup that indicates hedgers have still positioned for bearish risks in the months to come amid abrupt spikes in between. Capitalizing on rallies to write OTM puts will reduce the cost of long leg.

Hence, we advocate the diagonal options strategy on both hedging and trading grounds. Courtesy: Sentry, Saxo & Commerzbank

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?