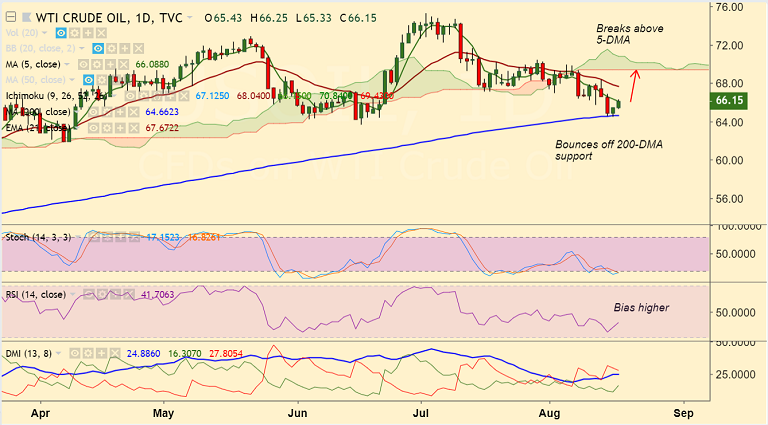

- US Oil is extending recovery from 8-week lows at 64.45, trades 1.1% higher at the time of writing.

- The pair trades higher for the 2nd straight session, bias higher as long as it holds above 200-DMA.

- 200-DMA is strong support at 64.66, we see weakness only on break below.

- Decisive break below 200-DMA will see scope then for test of 38.2% Fib at 62.57. Violation there could see further downside.

- Major trend still remains bearish, close above 5-DMA could see upside till 110-EMA at 67.18.

Support levels - 66.09 (5-DMA), 64.66 (200-DMA), 63.62 (June 18 low)

Resistance levels - 67.18 (110-EMA), 67.67 (21-EMA), 68

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -118.062 (Bearish) at 1300 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.