- US Oil slips below $67 per barrel mark, hits 6-week lows, bias lower.

- Oil prices are on the slide once again as constraints and supply buildups prove to be short-lived.

- After API report showed an unexpected rise in the US stockpiles, EIA data on Wed reported the US crude oil inventories went up by 3.803 million barrels during the week ended on July 27.

- Prices hit fresh multi-day lows after the OPEC announced it increased its production during last month.

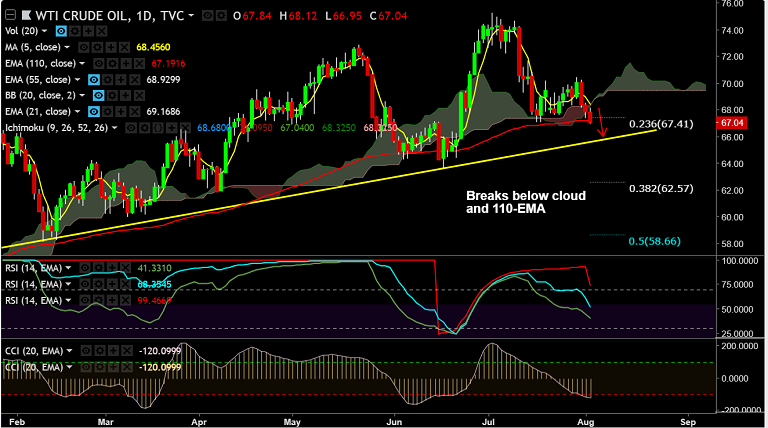

- Prices have slipped below 110-EMA and 23.6% Fib, on track to test trendline support at 65.55.

- Later in the week, Baker Hughes weekly report on the US drilling activity will be in focus for further impetus.

Support levels - 65.55 (trendline), 65, 64.26 (June 5 low)

Resistance levels - 67.19 (110-EMA), 67.41 (23.6% Fib), 68.46 (5-DMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -32.9275 (Neutral), while Hourly JPY Spot Index was at 27.0931 (Neutral) at 0745 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.