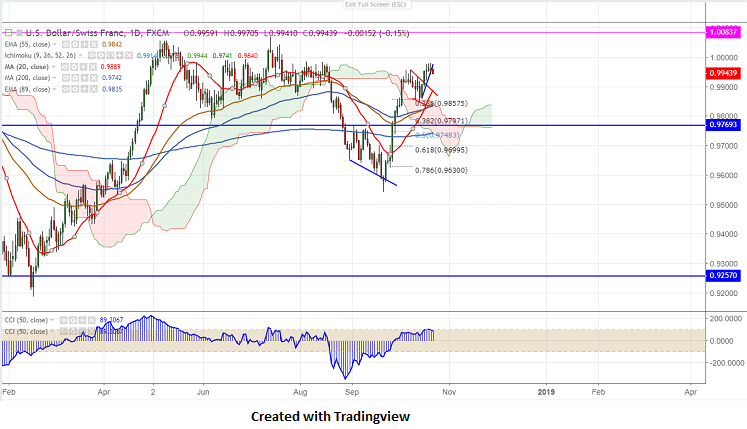

Ichimoku analysis (Daily chart)

Tenken-Sen - 0.9914

Kijun-Sen -0.9761

USDCHF is showing a minor weakness after hitting high 0.99800. The pair has formed almost a triple top and is struggling to break above 0.9980 level. It hits intraday low of 0.99410 and is currently trading around 0.99456.

Any break below 0.99399 low made yesterday confirms minor intraday weakness and break below targets 0.9875 (20- day MA)/0.9835 (89- day EMA).

On the higher side, any break above 0.9980 confirm minor bullishness , a jump till 1.000/1.00680.

It is good to sell on raliies around 0.9965-70 with SL around 1.000 for the TP of 0.9875.

Resistance

R1- 0.9980

R2 - 1.000

R3- 1.00680

Support

S1- 0.9940

S2- 0.9900

S3- 0.9870