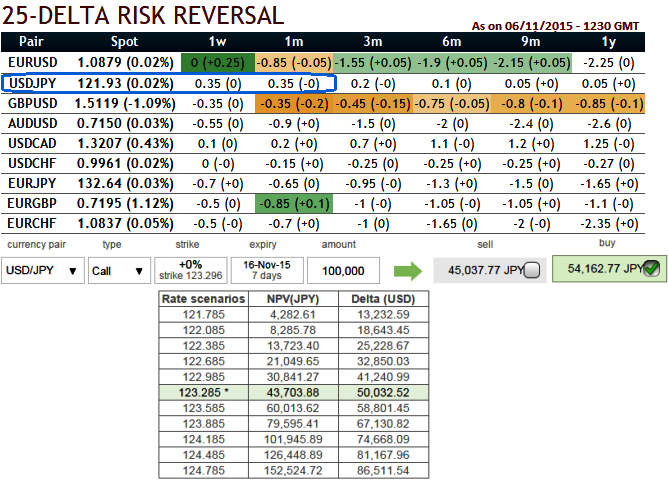

At the money calls seems costlier which divulges the market sentiments for USD/JPY pair (NPV of 1w ATM 50% delta call is 43703.88 while premiums trading above 23.93% at JPY 54162.77 for lot size 100,000 units).

From the nutshell showing delta risk reversal computation of ATM contracts and Net Present values of ATM instruments, it is understood that the ATM calls have been relatively on higher demand (this is just the resultant sentiments from recent rallies in this pair).

As a result we come up with suitable hedging framework for slight upside risks. Place backspreads using at the money calls in the 2:1 ratio instead of 3:2 ratios. Current USDJPY FX spot is ticking at 123.323.

How to execute: Buy two lots of ITM 0.5 delta call with longer expiry (let's say 1m tenor). Sell 4D OTM strike calls (124.275) or even shorter expiries. Thereby, we've formulated the strategy so as to suit the delta risk reversal to take the advantage of overpriced calls by shorting.

Unload in the money shorts as they seem highly risky, unload even at the money shorts, as per they risk reversal computation sooner ATM instruments are also likely to turn into in the money, hence thereby all chances of excising options would not be disregarded.

The delta value becomes more and more insensitive as the USD/JPY falls lower and lower and hence on the lower side, the delta value is zero.

FxWirePro: USD/JPY call backspread derives maximum yields - unload weights

Monday, November 9, 2015 7:32 AM UTC

Editor's Picks

- Market Data

Most Popular